- Option Income Project

- Posts

- Weekend Scare Forgotten. NATHs Back On. Bears Take Small Losses. | SPX Market Briefing | 13 Jan 2026

Weekend Scare Forgotten. NATHs Back On. Bears Take Small Losses. | SPX Market Briefing | 13 Jan 2026

DOJ Powell Bombshell? Markets Shrug. Run On New All-Time Highs Resumes.

And just like that, the weekend news scare is forgotten.

A run on new all-time highs again is made.

Nasdaq continues to lag but is finally starting to join the party – still a ways off from its own NATHs though.

And on a personal note – these intraday turnarounds are grinding my nutmeg.

Anyways – two small losses with the bear Tag n Turns as both SPX and RUT flip back to bullish. SPX -29.2% and RUT -6.1%.

I pre-emptively flipped on RUT as I am again away from the desk doing one of my favorite pastimes. For the sake of a tick or two prior to the final bell – I’ll take it as it saves me a headache trying to do it on my mobile tomorrow.

Both SPX and RUT are back to the bull swings. Time once again to wait and hope the chief idiot doesn’t tweet – speak – or forget to breathe.

Have fun folks.

CPI drops at 8:30. Bank earnings kick off. Scroll down.

Intraday turnarounds grind nutmeg. Small losses happen. Systems adapt. That’s not failure. That’s systematic trading in action.

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

Market Briefing:

Tuesday brings CPI and bank earnings whilst the market pretends Sunday night never happened. DOJ subpoenas the Fed Chair? Markets don’t care. NATHs back on the menu.

Current Multi-Market Status:

ES: 7,014.00 – at NATHs (7,016.25)

YM: 49,797 – at NATHs (49,876)

NQ: 25,955.75 – lagging, NATHs at 26,399

RTY: 2,647.9 – at NATHs (2,650.3)

GC: 4,601.8 – still elevated

CL: 59.46

VIX: 15.08 – dropped from yesterday’s 16.33

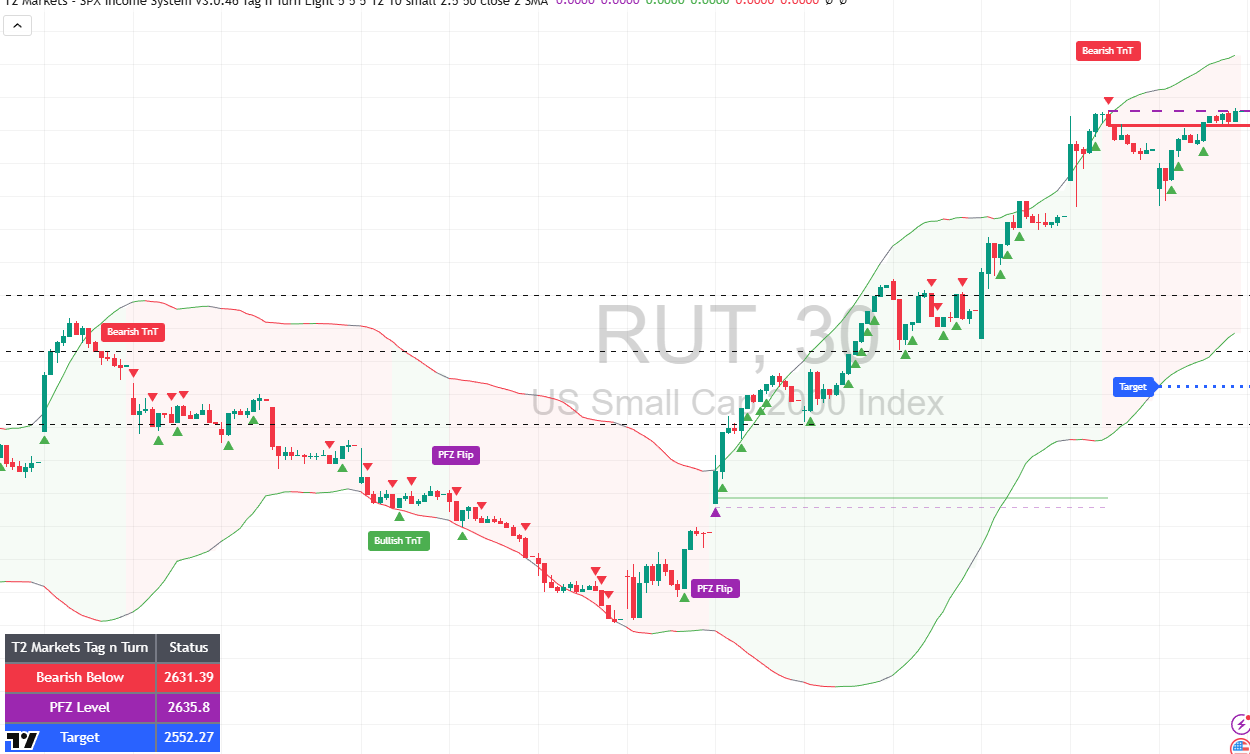

SPX – Flipped Back to Bullish

The bear TnT that triggered Friday? Done. Flipped back to bullish Monday.

Loss on bear swing: -29.2%

These intraday reversals are what they are. The system adapts. Small loss. Move on.

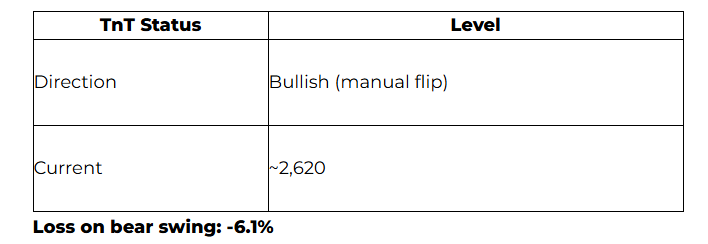

RUT – Pre-Emptively Flipped

I flipped RUT manually ahead of the official signal. Away from desk, doing favorite pastime, for the sake of a tick or two – I’ll take the early flip over fumbling with mobile tomorrow.

Loss on bear swing: -6.1%

Both indexes back to bull swings. Lockstep continues – just in the opposite direction now.

Nasdaq – Finally Joining

NQ at 25,955 with NATHs at 26,399. Still a ways off but finally showing signs of life. The laggard is starting to stir.

CPI Day

[Source: BLS, Morningstar]

The shutdown distorted October/November data. December should give a cleaner read – first proper checkpoint since the mess.

Expert Insights:

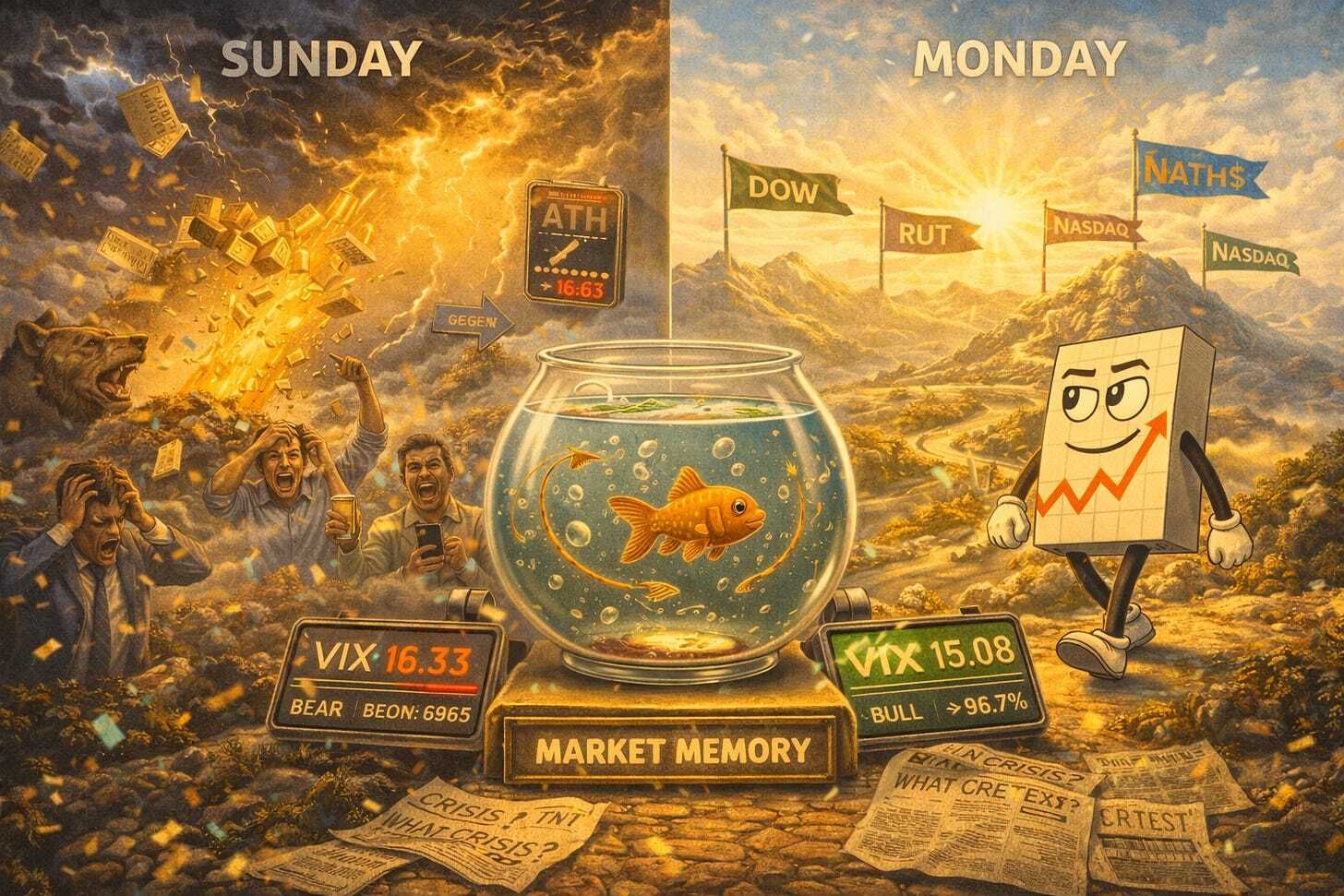

Markets have the memory of a goldfish with ADHD.

Sunday night: DOJ subpoenas Fed Chair Powell. Criminal indictment threatened. Fed independence under attack. Gold hits ATH. VIX spikes.

Monday: Completely forgotten. Run at NATHs. VIX drops from 16.33 to 15.08. Business as usual.

This is why systematic trading beats emotional reaction. The headlines scream disaster. The price action says “what disaster?” Bear TnTs flip to bullish. Small losses taken. Move on.

The chief idiot could tweet something market-moving at any moment.

Or not.

Can’t predict.

Can only position systematically and adapt when signals change.

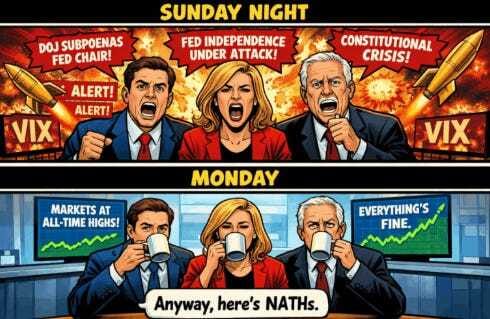

Meme of the Day:

“Sunday: ‘THE FED IS UNDER ATTACK! DEMOCRACY IS ENDING!’ Monday: ‘Anyway, here’s NATHs’”

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply