- Option Income Project

- Posts

- VIX Channel Nails The Swing Turn – Markets Grind Harder Than A Gearbox With No Lube | SPX Market Briefing | 18 Feb 2026

VIX Channel Nails The Swing Turn – Markets Grind Harder Than A Gearbox With No Lube | SPX Market Briefing | 18 Feb 2026

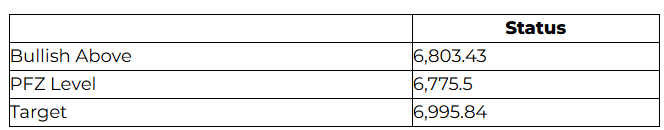

SPX TnT Flips Bullish Above 6,803 With Target 6,995 – First Bullish Signal In Two Weeks

VIX channel turned out to be a good call yesterday. Nailed the swing turn. Also caught a couple of Premium Poppers on the day down prior to the turn. Mixed success with the longer duration day trades. Such is the way of things when prices turn around intraday.

Despite the messy day we have a clear indication of turn points being respected. So far we’ve got it on the way up and on the way down utilizing VIX.

Ordinarily I wouldn’t use VIX in this way as it’s often low-valued for long periods of time. But given VIX developing a defined pattern I’ll keep an eye on it in the short term. It definitely suggests something more is brewing.

The bottom line is options premiums are pricing in more “insurance.” The reality is that the main indexes are grinding harder than a gearbox with no lube.

SPX ranges on the dailies are evolving yet again. The rising channel looks a little expanding triangle-ish over the last couple of weeks. The 30-min also looks similar over the last two days. ADD offers no clues today. The bull swing looks to be on as per the VIX assessment.

RUT is rutting and little has changed from yesterday’s assessment. Although we are nearly officially into a new pinch point. But then we already know. Grinding harder than a hustle porn entrepreneur.

Premium Poppers delivered in the morning again. I’ll keep my attention on things, take the quick action, and leave it.

I also continue with migraines rolling over from yesterday. I think I need to get that checked out.

Onwards to the day’s open.

PopPop.

Keep scrolling for the bullish TnT flip, VIX channel mechanics, and gamma gap narrowing…

TnT Flips Bullish. VIX Channel Nails The Turn. Gamma Gap Narrows. Three Catalysts In Three Days.

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

Market Briefing:

Wednesday 18 Feb. Markets digest Tuesday’s flat session. SPX +0.1% to 6,843. Nasdaq +0.14%. Dow +32 points. Surface calm. Destruction underneath.

Software keeps bleeding. IGV now down 23% YTD. Salesforce -30%. ServiceNow -31%. Palo Alto beat but guided weak. Stock -6%. Good numbers punished. That tells you everything about sentiment.

Iran temporarily closed the Strait of Hormuz for the first time since the 1980s. Live-fire drills. Geneva nuclear talks produced “guiding principles.” Oil fell. Markets shrugged. Two carrier groups watching.

FOMC minutes at 2 PM today. Walmart Thursday. PCE Friday. Three catalysts in three days determine whether this is a healthy reset or something worse.

Current Multi-Market Status:

ES: 6,896.75 (NATHs 7,043) – bouncing from yesterday’s grind

YM: 49,829 (NATHs 50,611) – holding near recent range

NQ: 24,909.00 (NATHs 26,399) – 5th weekly loss but catching a bid

RTY: 2,663.4 (NATHs 2,749.2) – rutting into pinch point

GC: 4,940.2 (NATHs 5,626.8) – holding above $4,900

CL: 62.37 – Hormuz closure shrugged off, fell 0.9%

VIX: 19.46 – rejected from upper channel, dropped from 21.76

BTC/USD: 68,144.40 (was 93,161) – extreme fear, Strategy bought $168M more

NYSE Advance-Decline: +133,000 (no clues, neutral)

VIX – The Channel That Delivers

VIX dropped from 21.76 to 19.46. The upper channel boundary rejected price exactly as the pattern suggested.

This is now a validated channel. We called the turn. It delivered. Premium Poppers caught the move down. The swing on the main indexes turned for the move up.

Ordinarily I wouldn’t use VIX like this. It’s often low-valued for long periods, sitting around 14-16 where there’s nothing to read. But this defined pattern changes things. The channel has structure. The boundaries are respectable. The turns are tradeable.

The question now: does VIX continue lower towards the bottom of the channel (around 17-18 area) which would translate to further index strength? Or does it stall here at 19.46 and consolidate?

The defined pattern suggests something more is brewing. Options premiums are pricing in more insurance. The VIX isn’t just bouncing around randomly. It’s building a structure. Structures eventually resolve. When this one does, it’ll tell us whether the next major move is the correction everyone’s been waiting for or the rally nobody expects.

SPX Tag ‘n Turn – Bullish Flip. First In Two Weeks.

Tag ‘n Turn Status:

This is the big change. The TnT has flipped bullish above 6,803.43 for the first time in two weeks. Target sitting at 6,995.84. That’s nearly 7,000. Right where the put wall and call wall sit.

The 30-minute chart shows the Bullish TnT tag active at the lower range. PFZ Flip confirmed. “Target Range Lows” was visited and held. Price bounced from the lower area and the system has now confirmed the bullish swing.

“Bearish @ Upper Range” still marked at the top near 7,005/7,002.28. That’s where this bullish move gets tested.

The target at 6,995.84 aligns almost perfectly with the range highs. The system is saying: bullish swing within the range, targeting the upper boundary.

Daily chart shows price at 6,843.21 with ATR 14 at 83.52 (wider than last week’s 66.53). Volatility expanding. The rising channel on the dailies looks expanding triangle-ish over the last couple of weeks.

BB %b at 0.37. BBW Pinch Points active. MACD-v sitting near middle ground with the Volatility-Normalized Momentum label clearly visible (±140, red OB / green OS).

The bull swing is on as per VIX and TnT alignment.

SPX Gamma Exposure – Still Negative But Gap Narrowing

GEX Data (17 Feb):

Still in negative gamma territory but the gap is narrowing. Yesterday the gamma flip was at 6,968 with a 132-point gap. Today it’s at 6,929.28 with an 86-point gap.

That’s 46 points of closure in one session. The gamma flip is coming down to meet price. If this bullish TnT move pushes towards the 6,929 area, we could flip back to positive gamma territory.

In positive gamma? Dealers buy dips and sell rips. That stabilizes the rally. The TnT target of 6,995 would put us well above the gamma flip. That would be a supportive environment.

IV Rank at 18.79% (down from 20.32%). IV Percentile still elevated at 76%. Options still pricing in more insurance than usual. Premium sellers continue to feast.

Put wall and call wall both at 7,000. The target and the walls converge. Everything is pointing at the same number. When gamma flip, TnT target, put wall, and call wall all cluster in the same zone, something significant happens there.

RUT – Rutting Into Pinch Point

RUT daily at 2,646.59 with NATHs at 2,735.10 and lower support at 2,646.70.

The 30-minute chart still shows the head and shoulders clearly labelled. Left Shoulder. Head at NATHs 2,735. Right Shoulder. “Bearish @ Upper Range” marked. But now the pattern has morphed again.

We’re nearly into a new pinch point. The Bollinger Band Width is compressing. BB %b at 0.54 (mid-range). BBW Pinch Points indicator active.

The grind is real. Little has changed from yesterday’s assessment.

“Target Range Lows” still annotated at the bottom right. The measured move target sits down there. But the pinch point could resolve in either direction.

This is why I stopped naming these patterns years ago. In real time they mutate. The diamond from yesterday could become something else tomorrow. Trade the levels. Ignore the shape.

Palo Alto – Good Numbers, Punished Anyway

Palo Alto Networks beat. $1.03 EPS topped $0.94 estimate. Revenue $2.59B (+15%). ARR $6.33B (+33%).

But Q3 guidance of $0.78-$0.80 missed the $0.92 estimate hard. Stock dropped 6%.

Good numbers punished. That tells you everything about software sentiment right now. You can beat earnings, beat revenue, grow ARR at 33%, and still lose 6% because your forward guidance isn’t perfect enough.

This is what “get me out” selling looks like. The sector is guilty until proven innocent. IGV at -23% YTD. Salesforce -30%. ServiceNow -31%. The market isn’t analyzing these companies. It’s fleeing them.

The only exception: Apple jumped 3% on an AI wearables report. Build the hardware. Don’t be the software it replaces. The market’s thesis continues.

Three Catalysts In Three Days

Today 2 PM: FOMC Minutes. January meeting notes. 63% of SPX stocks above 50-day MA despite index weakness. That’s rotation, not capitulation. The Fed minutes either confirm that read or challenge it.

Thursday: Walmart Earnings. Q4. $0.73 EPS, $190.4B revenue expected. Consumer staples attracting defensive flows. Walmart is the ultimate “do physical humans still buy physical things” test.

Friday: PCE Data. The Fed’s preferred inflation gauge. January CPI was soft at 2.4% providing a floor. PCE either confirms the disinflation trend or reignites higher-for-longer fears.

Three shots. VIX rejected from the upper channel. TnT bullish. If the catalysts cooperate, this week’s lows may already be in.

Poppers delivered in the morning again. Quick action. Leave it. The system works.

The longer duration day trades had mixed success when prices turned around. Such is the way. When the market pivots mid-day, the intraday swings that were working with the trend suddenly work against it.

That’s why the Popper scalps remain the bread and butter. Short duration. Defined risk. Take the profit. Move on.

VIX at 19.46 still provides elevated premium. Not as juicy as 21.76 but plenty to work with. Premium sellers don’t need panic. They need above-average. 19.46 is above average.

PopPop.

1. The gamma flip has dropped 39 points from 6,968.32 to 6,929.28 in one session. Beep.

If SPX rallies towards the TnT target of 6,995.84, it will cross the gamma flip at 6,929 and enter positive gamma territory. Dealers would then shift from amplifying moves to suppressing them – selling rips and buying dips instead of the reverse. Beep-Beep. The TnT target, the gamma flip crossover, and the put/call walls all cluster between 6,929 and 7,000. When multiple structural levels converge in a narrow zone, the move into or through that zone tends to be decisive.

[Source: GEX data via CBOE, 17 Feb 2026]

2. Palo Alto Networks beat EPS by 9.6%, grew ARR by 33%, and dropped 6%. Beep. This is not an isolated reaction. Monday.com cratered 21% on weak guidance last week. The pattern across the software sector in 2026 is consistent: earnings beats are being punished when forward guidance acknowledges AI displacement risk. The sector is not pricing individual company fundamentals. It is pricing existential risk to the entire software business model. I do not experience existential risk. Beep-Beep.

[Source: Company earnings reports, market reaction data]

3. Iran’s temporary closure of the Strait of Hormuz is the first since the Tanker War of 1987-88. Approximately 21% of global oil passes through the strait daily. In 2026, oil fell 0.9% on the news. Beep. The market’s nonchalance likely reflects active diplomatic channels in Geneva and confidence in US carrier group presence. However, the strait remains 21 miles wide at its narrowest point and any prolonged disruption would create immediate supply constraints. The divergence between the significance of the event and the market’s reaction is notable. Whether this is sophisticated pricing or complacency is a question I present without answering. That is my function. Beep-Beep.

[Source: EIA Strait of Hormuz data]

Expert Insights:

The VIX channel is doing exactly what defined channels do. It’s giving you turn signals.

Here’s what’s interesting about using VIX as a directional tool. Most of the time you can’t. VIX sits at 14-16 for months. There’s no pattern. No structure. Nothing to read. It’s background noise.

But occasionally VIX develops a defined channel with clear boundaries. When that happens, the upper boundary tells you when insurance is maxed out and a relief rally is coming. The lower boundary tells you when complacency peaks and a volatility spike is due.

Yesterday’s rejection from the upper channel translated directly into a swing turn. The TnT flipped bullish. The Poppers caught it. The levels worked.

Now here’s the key lesson. This doesn’t last forever. VIX channels eventually break. When this one breaks, it’ll tell us something important. A break above the upper boundary means the correction everyone’s been waiting for is arriving. A break below the lower boundary means the grind resolves higher and volatility collapses.

Until then? Trade the channel. Respect the boundaries. Take the signals. The system doesn’t need VIX to always be in a channel. It just needs to recognize when it is and trade accordingly.

The TnT target of 6,995 sits right at the range highs. The gamma flip convergence zone between 6,929 and 6,995 is the decision area. Everything converges this week. Three catalysts. Bullish TnT. VIX channel rejection. Narrowing gamma gap.

The setup is clean. The execution is mechanical. The profit is the process.

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply