- Option Income Project

- Posts

- Venezuela Chaos, Gold Lifts Off, Santa Never Called | SPX Market Briefing | 5 Jan 2026

Venezuela Chaos, Gold Lifts Off, Santa Never Called | SPX Market Briefing | 5 Jan 2026

95.3% Win Rate Walks Into 2026 Looking For More Premium to Pop

We finished 2025 with a 95.3% win rate. Not bad. Now let’s see if we can keep the momentum rolling.

But first – what the actual hell happened over the weekend?

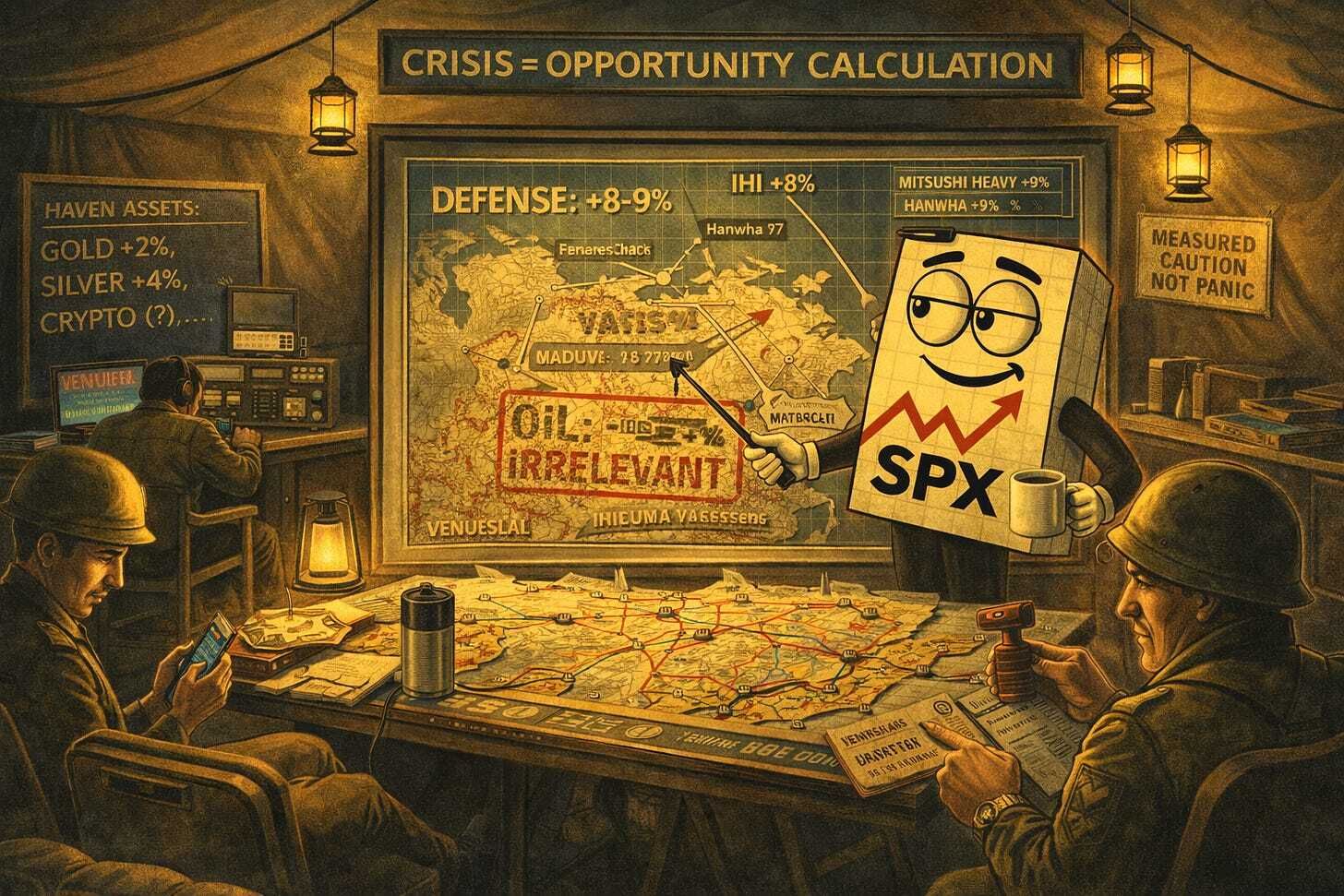

The US decided to start 2026 by capturing Venezuela’s president. Maduro’s appearing in a New York courtroom today. Trump says America’s “in charge” now. Gold’s already lifted off to 4,450. Oil’s watching nervously from the sidelines. The UN Security Council is meeting. And somewhere, a geopolitical risk analyst just cancelled their holiday.

For us systematic traders? Business as usual. The Tag n Turn on SPX went bullish last week. RUT remains bearish. The setups don’t care about headlines – they care about price.

Let’s break down what matters for today.

The world’s gone mad. Your system hasn’t. Scroll down.

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

Market Briefing:

Well, well, well. We’re back at the desk proper after an excellent finish to the year.

And what a way to start 2026.

The Venezuela Situation

Over the weekend, the US conducted military strikes in Venezuela and captured President Maduro. He’s appearing in a New York federal court today on drug trafficking charges. Trump’s saying America is “in charge” of Venezuela now. The UN Security Council is meeting. China’s condemning “hegemonic bullying.” 32 Cubans were killed in the operation.

It’s… a lot.

What the Markets Are Doing

Here’s the interesting bit: markets are relatively calm.

Gold’s already lifted off – sitting at 4,450 and breaking out of its recent downtrend. This makes sense. Geopolitical chaos = flight to safety.

Oil? Still in its downtrend channel at 57.39. You’d think Venezuela = oil spike, but markets seem to be pricing in US control of Venezuelan oil reserves rather than supply disruption. For now.

VIX? Asleep at 15.17. The fear gauge doesn’t seem particularly bothered. Yet.

Equities? Futures are slightly higher. ES at 6920.75.

The Tag n Turn Picture

SPX went bullish last week. Currently at 6858.48, which is above our bullish trigger of 6850.53. Target sits at 6934.47. The PFZ level is 6828.99 – that’s our line in the sand.

RUT remains bearish. Flipped below 2515.68 and currently sitting at 2508.22. This divergence between SPX and RUT continues to be the story. Big caps holding up, small caps struggling.

Santa Rally? Never Showed

I think it’s fair to say the Santa Rally failed to call.

We talked about it. We watched for it. It didn’t materialize.

Now we look towards the next markers that will potentially guide how the year unfolds. January’s price action often sets the tone – the “January Barometer” will be getting attention soon.

What I’m NOT Watching Today

ISM Manufacturing PMI drops at 10:00am ET. Forecast is 48.3 (previous 48.2). Still in contraction territory but stable. This could set the early tone.

Maduro Court Appearance at noon ET. Headlines will flow. Probably noise for markets but worth noting.

What I am Watching Today

Premium Popper Setups – I’m looking to keep my win streak rolling. The system doesn’t care about Venezuela. It cares about ORB levels and VWAP.

Friday’s the big one. NFP forecast is just 57K (previous 64K). Weak number could move markets.

Looking Ahead

The world’s doing world things. Chaos, headlines, captured presidents, breaking news.

Your system? It’s doing system things. Bullish triggers, bearish flips, premium decay.

One of these approaches leads to consistent profits. The other leads to emotional trading and ulcers.

Stay mechanical. Stay boring. Stay profitable.

PopPop.

Expert Insights:

When Geopolitics Meets Price Action

Here’s what history tells us about geopolitical shocks and markets:

They make headlines. They create volatility spikes. And then… usually… markets move on.

The key question isn’t “what happened?” but “does this affect earnings, inflation, or growth?”

Venezuela’s oil reserves are massive – but global oil markets have been well-supplied. Unless this escalates into broader conflict affecting actual supply chains, markets tend to treat these events as noise.

What matters for us today:

SPX is bullish above 6850.53

RUT is bearish below 2515.68

Premium Popper setups will fire based on opening range, not Caracas

The system doesn’t read the news. Neither should your execution.

Fun Fact:

The January Barometer

Here’s something to watch this month: the “January Barometer” – the theory that January’s performance predicts the full year.

According to Stock Trader’s Almanac data, when the S&P 500 is up in January, the full year has been up 86.4% of the time since 1950. When January is down, full year performance becomes much more mixed.

The first five trading days are particularly watched – the “First Five Days” indicator. If the market is up after the first five days (that’s through this Friday), it’s historically been a positive sign for the year.

Of course, Santa was supposed to call too. And look how that turned out.

[Source: Stock Trader’s Almanac, Jeff Hirsch]

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply