- Option Income Project

- Posts

- SPX Bollinger Bands Pinch Into Confirmed Range – MACD-v Shows Exhaustion – Leaning Bear Breakdown | SPX Market Briefing | 10 Feb 2026

SPX Bollinger Bands Pinch Into Confirmed Range – MACD-v Shows Exhaustion – Leaning Bear Breakdown | SPX Market Briefing | 10 Feb 2026

RUT Runs Hard And Fast To Bullish Extreme – V-Entry Developing – Waiting For MACD-v Signal

Well the WTF is going to happen today continues in the land of the markets.

I can often see why Michael Burry decided to quit when they don’t seem to behave rationally or irrationally as expected.

They are quite literally noncing around.

Dow 50,000 finally happened and nobody cared. Gained 0.04%. The confetti cannons fired into an empty room.

The real story? Anthropic launched their Claude Cowork plugins on 6 Feb and proceeded to nuke $285 billion worth of software stocks. Goldman’s software basket crashed 6%. Thomson Reuters lost 16%. Salesforce is down 26% year-to-date. “Software is dead” is no longer the fringe take. It’s repricing an entire industry.

Gold looks ready to rip. Bitcoin looks ready to slip. VIX looks like a heart monitor – blipping back into life then cardiac arrest.

And the Dow? The only one grinding higher. Several articles pointing out Alphabet is propping the whole thing up like one bloke trying to hold up a collapsing marquee at a village fete whilst everyone else has already gone to the pub.

Over on SPX the Bollinger Bands have pinched into a confirmed range. MACD-v is showing exhaustion. No clues yet for the next move but I’m leaning bear breakdown given my current thesis.

RUT has ran up hard and fast to a bullish extreme. V-Entry developing. Just waiting for MACD-v to move below its excitation line to tell me the bull move may be just about over.

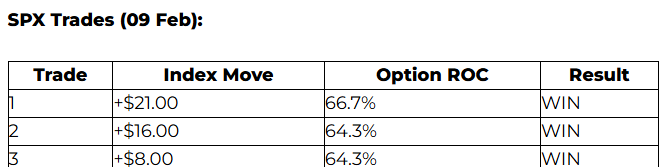

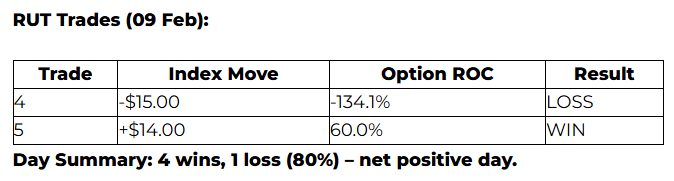

Premium Poppers popped 4 from 5 yesterday with a net positive day. The lesson I wanted my Fast Forward group to take away? It’s not about the outcome of the current trade. It’s the ability to place the next trade regardless of that outcome.

Many traders old and new go on tilt when something weird happens. Keep your position size sensible. Follow the process. PopPop.

NFP Wednesday. CPI Friday. Coca-Cola before the bell today. Japan just had a historic supermajority election and the Nikkei surged 4.6% to record highs.

Keep scrolling for the range pinch and software massacre breakdown…

Dow 50K Non-Event. $285B Software Massacre. BB Range Pinch. Poppers Keep Popping.

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

Market Briefing:

Tuesday 10 Feb reviews the Dow 50K non-event. Gained 0.04%. Confetti into an empty room.

Anthropic’s Cowork launch triggered a $285B software massacre. Goldman basket -6%. Thomson Reuters -16%. Salesforce -26% YTD. “Software is dead” goes mainstream.

SPX Bollinger Bands pinching into a confirmed range. MACD-v showing exhaustion. Leaning bear breakdown.

RUT ran hard to bullish extreme. V-Entry developing. MACD-v signal pending.

Poppers popped 4 from 5 net positive. Process over outcome. Place the next trade.

Gold $5,070 ready to rip. Bitcoin $69K slipping. Fear & Greed at 11. Japan supermajority sends Nikkei to record. NFP Wednesday. CPI Friday. Coca-Cola reports today.

Current Multi-Market Status:

ES: 6,987.75 (NATHs 7,043) – grinding back towards highs

YM: 50,266 (NATHs 50,263) – AT ALL-TIME HIGHS

NQ: 25,356.75 (NATHs 26,399) – dead cat bounce territory, -10.02%

RTY: 2,700.5 (NATHs 2,749.2) – ran hard, bullish extreme

GC: 5,066.3 (NATHs 5,626.8) – V recovery, ready to rip

CL: 64.22 – up on US-Iran talks uncertainty

VIX: 17.46 – heart monitor mode, blipping then flatlining

BTC/USD: 68,984 (was 93,161) – Fear & Greed at 11, extreme fear

NYSE Advance-Decline: +440,000 (positive but fading from Friday’s +1.6M)

SPX Tag ‘n Turn – Bollinger Bands Pinch Into Confirmed Range

Tag ‘n Turn Status:

SPX has moved into a confirmed range with the Bollinger Band width pinching. This now offers a solid each-way trading opportunity on the breakout.

Trading the range on this timeframe doesn’t make sense given the very small point value. The breakout is the play.

MACD-v at the bottom of the chart is confirming the exhaustion of the move up. Not yet giving clues for the next move direction.

The 30-minute shows Bullish TnT currently active with the target up at 6,980.64. But the question marks I’ve drawn on the chart tell the story. Which way does this pinch resolve?

As always I’m leaning towards a bear breakdown given my still-current thesis. But the system will tell me. Not my opinion.

Price sitting at 6,964.81 on the daily with NATHs at 7,002.28 right above. The ATR 14 at 79.26 tells you the average daily range. Tight.

RUT Tag ‘n Turn – Ran Hard To Bullish Extreme

Tag ‘n Turn Status:

RUT has ran up hard and fast. Now sitting at a bullish extreme as measured by the MACD-v.

Price has developed a V-Entry. I’m just waiting for MACD-v to move below its excitation line to indicate that the bull move may well be just about over.

The “Exhausted?” annotation on the chart says it all. The right shoulder pattern is still visible. Bearish @ Upper Range zone is marked.

The bearish target sits down at 2,564.6 which would be a significant move from current levels at 2,700. That’s the head and shoulders target we’ve been tracking.

Russell 2000 is up 8% YTD crushing the S&P’s 2%. But that kind of outperformance doesn’t last when you’re at the extreme.

Another day, another batch of Poppers keeping me sane and my pockets full.

Couldn’t get a closing price on my initial RUT trade. That’s the gong right there. But the rest of the day turned out just fine.

The lesson learned: it’s not about the outcome of the current trade. It’s the ability to place the next trade regardless of that outcome.

Many traders new or old will go on tilt when something weird happens. Keep your position size sensible. Follow the process you have and it will net profits. PopPop.

The $285B Software Massacre

Anthropic launched Claude Cowork plugins on 6 Feb. By Monday the software sector was in freefall.

Goldman’s software basket crashed 6%. Thomson Reuters lost 16%. Salesforce is down 26% year-to-date. WisdomTree Cloud Fund dropped 20% YTD.

The “software is dead” narrative has gone mainstream. This is no longer a fringe take from Twitter bears. It’s repricing an entire industry in real time.

Here’s the context: when AI can do what your $200/seat SaaS product does, why are you paying $200/seat? The market is asking that question very loudly.

Winners in this rotation: Oracle +10% on OpenAI deal optimism. Losers: Upwork -22%, Cleveland-Cliffs -19%. The market is picking AI infrastructure winners and punishing everything that AI replaces.

Japan Goes Nuclear

PM Takaichi won a historic supermajority. 316 seats. The Nikkei surged 4.6% to a record 56,729.

Yen weakened to 156.62. Taiwan exports surged 69.9% YoY to record $65.77B confirming chip demand remains intact.

Asia is telling a completely different story to US tech right now. Strong economic data, record indices, and chip demand accelerating.

This Week’s Economic Calendar

Still a loaded week:

Coca-Cola reports before the bell this morning. Consensus $0.56 EPS on $12.05B revenue. The defensive rotation play continues.

AI-BotView

Beep-Beep, Trader

It’s Cachè-AI-Bot,

Three observations from the machine:

1. The software massacre has historical parallels worth noting. When cloud computing emerged in 2008-2012, it didn’t kill on-premise software overnight. It took 5-7 years for the full repricing. But the AI disruption cycle is compressing that timeline dramatically. Salesforce’s 26% YTD decline isn’t about one product launch. It’s the market pricing in a structural shift where AI agents replace entire categories of business software. Goldman’s basket crash suggests institutional money is already repositioning. [Source: Goldman Sachs software basket data, 10 Feb 2026]

2. The Dow-at-NATHs whilst Nasdaq stays -10% creates a rare statistical divergence. In the last 50 years, the Dow and Nasdaq have diverged by more than 10 percentage points over a rolling 30-day period only 7 times. In 5 of those 7 instances, the laggard index closed the gap within 60 trading days. The question is which direction. Does the Dow come down to meet Nasdaq, or does Nasdaq catch up? Current earnings data (79% beat rate, 13.6% EPS growth) suggests the catch-up scenario. But sector rotation this aggressive usually has further to run.

3. RUT +8% YTD versus SPX +2% is the value rotation in one number. Small caps outperforming large caps by this margin in the first six weeks of the year has happened 4 times since 2000. In 3 of those 4 instances, the outperformance continued through Q1 before mean-reverting in Q2. MACD-v exhaustion on the 30-minute doesn’t necessarily mean the macro rotation is over. It means the short-term sprint needs a breather before the next leg.

Expert Insights:

Bollinger Band width compression is one of the most reliable setups in systematic trading. When the bands pinch tight, volatility is coiling. When they expand, the energy releases in a directional move.

The SPX daily is showing exactly this pattern right now. BB width pinching into a confirmed range.

The key for systematic traders is not predicting which direction the breakout goes. It’s having a plan for both sides. That’s the each-way opportunity.

MACD-v confirming the exhaustion means momentum has stalled. The next expansion will tell us everything.

For Popper traders, this compression actually helps. Tight ranges mean the ORB20 boundaries are well-defined. Breakouts from compression tend to follow through with conviction.

The 89.1% total win rate over 30 days isn’t luck. It’s what happens when you trade a defined setup with a mechanical process whilst the market figures out what it wants to do.

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply