- Option Income Project

- Posts

- Sell America Headlines Scream Crisis While Price Action Says Bearish Not Crashing

Sell America Headlines Scream Crisis While Price Action Says Bearish Not Crashing

SPX Market Briefing | 21 Jan 2026

I do love a good sensationalized headline.

“Sell America Trade Finally Happens!” “Danish Pensions Exit!” “US No Longer Safe Haven!” The financial media is having an absolute field day with this one.

Now, I’m not saying I’m not enjoying the selloff – the bear swings from last week are paying out beautifully. But let’s pump the brakes on the apocalypse narrative, shall we?

These 1-2 day selloffs have been very short-lived over the last 12 months. Every single one. The “this is it, the big one!” headlines have appeared roughly seventeen times since last January, and roughly seventeen times they’ve been followed by “markets recover on bargain hunting.”

I will continue to trust the price action. Which does agree there’s more downside. But we are not crashing – at least not yet.

Yes, these moves are bigger than we’ve seen in the last 3-6 months from a price range perspective. But 1.5% moves? That’s the upper end of volatile market norms. Bearish? Absolutely. Crashing? We are not.

Keep scrolling – the charts tell a calmer story than the headlines…

When Headlines Scream, Systems Execute.

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

Market Briefing:

The Flight to Safety Scoreboard

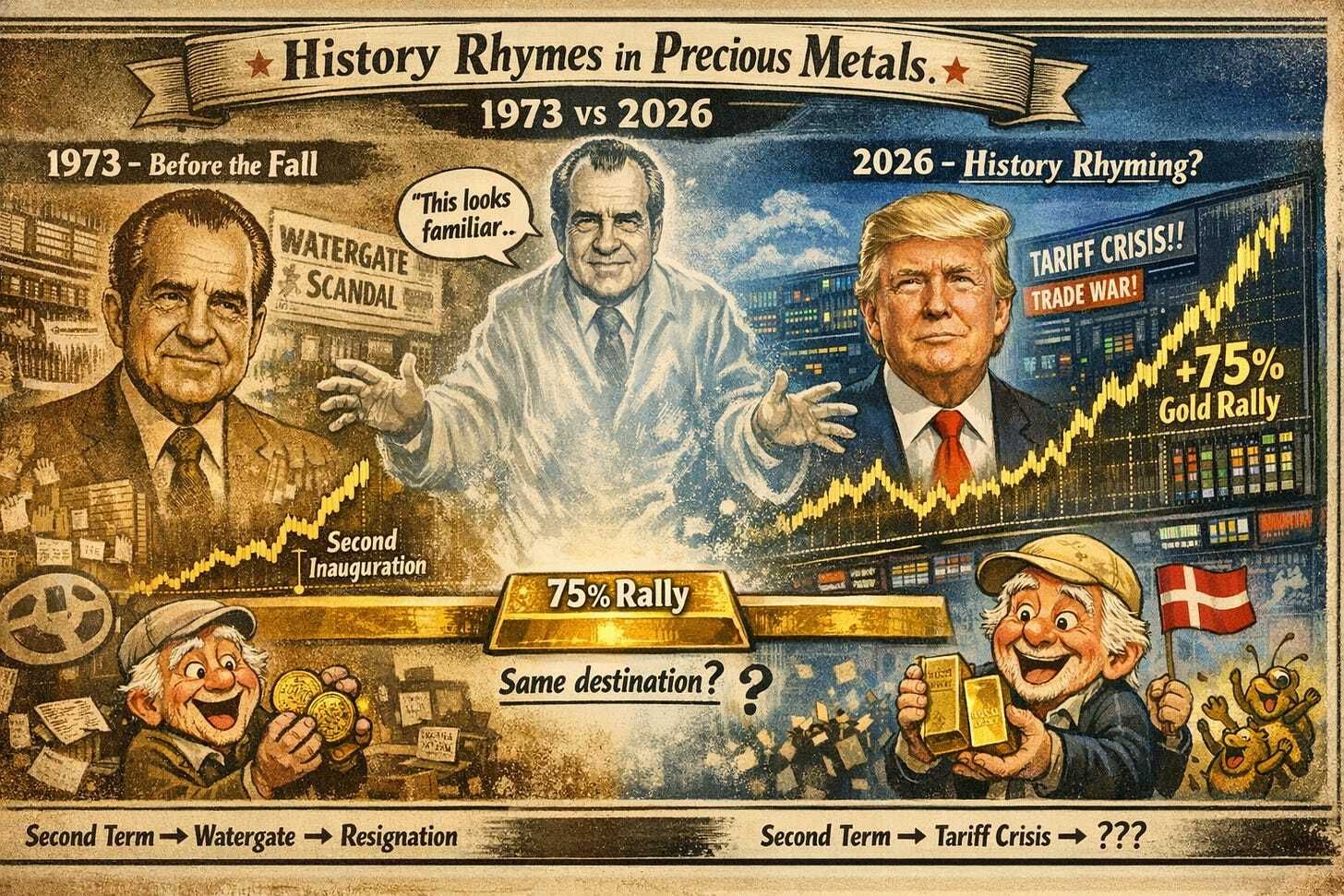

Gold: On a rampage higher. Classic flight to safety behavior. The precious metal doesn’t lie – when uncertainty spikes, gold catches a bid. Currently smashing through all-time highs at 4,891.

Bitcoin: Once again proving it’s not the “new flight to safety” that crypto bros promised. When real fear hits, institutions reach for the shiny stuff, not the digital stuff.

Main Indexes: Continuing to slide as expected. Last week’s bear swings are starting to pay out exactly as the patterns suggested.

Current Multi-Market Status:

SPX: TnT Bearish Below (Flipped) – Status 6833.29 – PFZ 6863.35 – Target Pending

RUT: TnT Bearish Below (Flipped) – Status 2683.68 – PFZ 2688.63 – Target Pending

ES: 6,840.50 – Target 2 at 6,675.25 in sight

YM: 48,690 – Target 2 at 46,602 on radar

NQ: 25,150.75 – Firmly in breakout move

RTY: 2,664.4 – Clinging near highs, lagging

GC: 4,891.1 – NATHs, rampage mode

CL: 60.34 – Bouncing in channel

VIX: 19.82 – Holding elevated levels

BTC: 93,161.86 – Craft fag territory

NYSE Breadth: -1,547,000 (very negative)

The Range Breakdown Analysis

SPX and Dow: Have moved from upper range to lower range and are now challenging breakouts. The journey from range highs to range lows is complete – now the question is: break or bounce?

Nasdaq: Has less distance to travel and is firmly in a breakout move already. Tech leading the charge lower, as it often does.

Russell 2000: Clinging on near the highs like a stubborn toddler refusing to leave the playground. Yet to move decisively back into the range.

I’m not seeing this as secret strength in the markets. RUT has a tendency to either lead the charge or lag the dive – doing its own thing most of the time. It’ll get there eventually.

My Setup Today

SPX at range lows and challenging a breakout. This is decision time.

I will continue to be cautious with the Tag ‘n Turns – which worked very nicely yesterday to avoid getting flipped and flopped. I’ve marked off the potential bull AND bear paths because at range lows there are always two choices:

Bull Path: Bounce from range lows, reclaim the range, work back towards highs.

Bear Path: Break through range lows, enter breakdown territory, extended move lower.

My new unofficial tool (soon to be integrated into the SPX Income System) on the lower chart area is telling me we have a strong trending move and momentum is still increasing.

A quick look at the overnight futures confirms we’ve broken yesterday’s lows – usually a sign of continuation.

RUT: The Laggard Setup

While lagging slightly, RUT is showing similar characteristics but looks more like a false bullish range breakout that’s now setting up for the break back into the range.

My new tool is also showing strong bear trending moves on RUT and has not exhausted yet. Conservative Tag ‘n Turn entries as needed – otherwise the bear remains.

Translation: RUT is about to play catch-up. I’m positioning accordingly.

The VIX Difference

Worth noting: VIX is holding its elevated levels compared to the last time it blipped higher. Previous spikes faded quickly. This one is settling in at the higher range.

That’s telling me the options market expects continued volatility. Premium sellers, take note – elevated VIX means fatter premiums to collect.

Expert Insights:

Bearish Isn’t Crashing

There’s an important distinction the financial media loves to blur: being in a bearish move is not the same as crashing.

A 1.5% daily move, while uncomfortable for the buy-and-hold crowd, is within normal parameters for volatile market conditions. We’ve seen these regularly throughout the last decade. They feel dramatic. They generate headlines. They mostly resolve.

The systematic approach doesn’t care about the narrative. It cares about the levels. Range lows are range lows. Breakout territory is breakout territory. The rules don’t change because a journalist found a catchy “Sell America” headline.

Trust the price action. Follow the patterns. Let the headlines entertain someone else.

Fun Fact:

Gold’s 75% rally since Trump’s second inauguration marks the sharpest one-year presidential move since Nixon’s second term began in January 1973 – just before Watergate brought him down. History doesn’t repeat, but it certainly rhymes in precious metals. Is Trump heading the same direction as Nixon? The gold market seems to be hedging its bets.

[Source: Historical gold price data comparison, January 1973 vs January 2025-2026]

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply