- Option Income Project

- Posts

- Risk of Being Dull: Bear Swing Still Bearish, Theta Still Dripping | SPX Market Briefing | 27 Aug 2025

Risk of Being Dull: Bear Swing Still Bearish, Theta Still Dripping | SPX Market Briefing | 27 Aug 2025

Inside Day Unfolds Exactly as Expected – Low Breached, High Breached at Final Bell

At the risk of being dull and boring, the bear swing is still bearish. Sometimes systematic trading feels repetitive because it works – and working approaches tend to look similar day after day until they don’t.

Yesterday’s inside day behavior unfolded exactly as expected: low breached, followed by high breached… only just and at the final bell. Classic whipsaw action that stops out breakout chasers while rewarding systematic patience.

The thing we have in our favor is that theta is dripping in, so as long as we don’t move higher, we can cash out with a profit given a few days of passage. Of course, should we move lower, we get paid a little faster – as always with systematic approaches.

Bull PFZ level remains at 6480 should we push higher before seeing a fresh bull Tag ‘n Turn setup. Clear levels, clear rules, clear execution – sometimes the most profitable trading is the most boring trading.

Keep scrolling for systematic deployment and theta wisdom…

Most Trade SPX Blind. You’ll Trade It Like You Designed It.

Pulse bars flip the lights on. You see it. Trade it. Bank it.

Unlock the SPX Strategy!

SPX Market Briefing:

Wednesday brings us exactly what systematic traders appreciate: clear continuation of established patterns with precise levels marking potential changes.

Current System Status:

Tag ‘n Turn: Still bearish with systematic precision

Bull PFZ Level: 6480 marking potential reversal zone

Yesterday’s inside day: Performed exactly as whipsaw expectations predicted

Theta decay: Working in our favor regardless of directional movement

Time advantage: Profit potential increases with passage of days

The Inside Day Validation: Yesterday proved why systematic traders focus on probability rather than possibility. The inside day delivered its classic double-fake: breach the low (stop out bulls), then breach the high at the final bell (stop out bears). Meanwhile, systematic approaches benefited from the sideways grinding that frustrated breakout seekers.

Theta Dripping Philosophy: The beauty of well-constructed systematic approaches is that time works in your favor multiple ways. Moving lower accelerates profits through directional advantage. Staying sideways allows theta decay to work its magic. Only moving significantly higher creates challenges – and even then, we have clear levels (6480 PFZ) that define when conditions change.

Today’s Mechanical Deployment:

Tag ‘n Turn: Remaining bearish until conditions dictate otherwise. Clear, simple, systematic.

Premium Popper & Lazy Popper: Simply awaiting algo entry signals after opening bell. No forcing, no predicting, just mechanical response to systematic conditions.

The Boring Advantage: At the risk of being repetitive, systematic trading often feels dull because it works consistently rather than dramatically. The excitement comes from reliable results rather than adrenaline-pumping uncertainty.

In Other News…

Futures flatlining like Wallie’s ambition

E-mini S&P stumbled to -0.17% by 9:25 AM like Percy after his morning decaf disappointment. Nasdaq managed -0.25% while Dow barely bothered with -0.05% – collectively displaying all the enthusiasm of Kash doing expense reports. Overnight ranges tighter than Mac’s grip on the good coffee beans, proving markets can bore themselves into submission.

Energy finds its backbone again

Brent crude staging a comeback like a rejected X-Factor contestant, dragging energy integrateds along for the ride while refiners follow like obedient lapdogs. Transport stocks surrendering Monday’s jet-fuel euphoria faster than abandoned New Year’s resolutions. Tech sector having an identity crisis – semiconductors cowering ahead of DC policy chatter while software creeping higher on softer rate hopes.

Earnings confessional gets messy

Zoom beat expectations then immediately dampened spirits by guiding Q4 margins flat, citing AI infrastructure spending – shares diving 3% premarket like disappointed investors jumping ship. Best Buy raising full-year outlook because apparently people still buy expensive gadgets during uncertain times. JD.com teasing early sales numbers for China’s 8.8 festival, proving shopping addiction transcends national boundaries.

Cross-asset reality check incoming

Dollar index flexing to 97.6, up 0.4% like it remembered it has bills to pay. Ten-year yield climbing to 4.31% while gold slumped to $3,310 like it’s lost faith in monetary chaos. Brent bounced to $66.0, WTI at $62.1 – oil prices moving with more conviction than government policy promises. VIX ticked up to 13.7 because apparently someone remembered markets can actually go down sometimes.

Expert Insights:

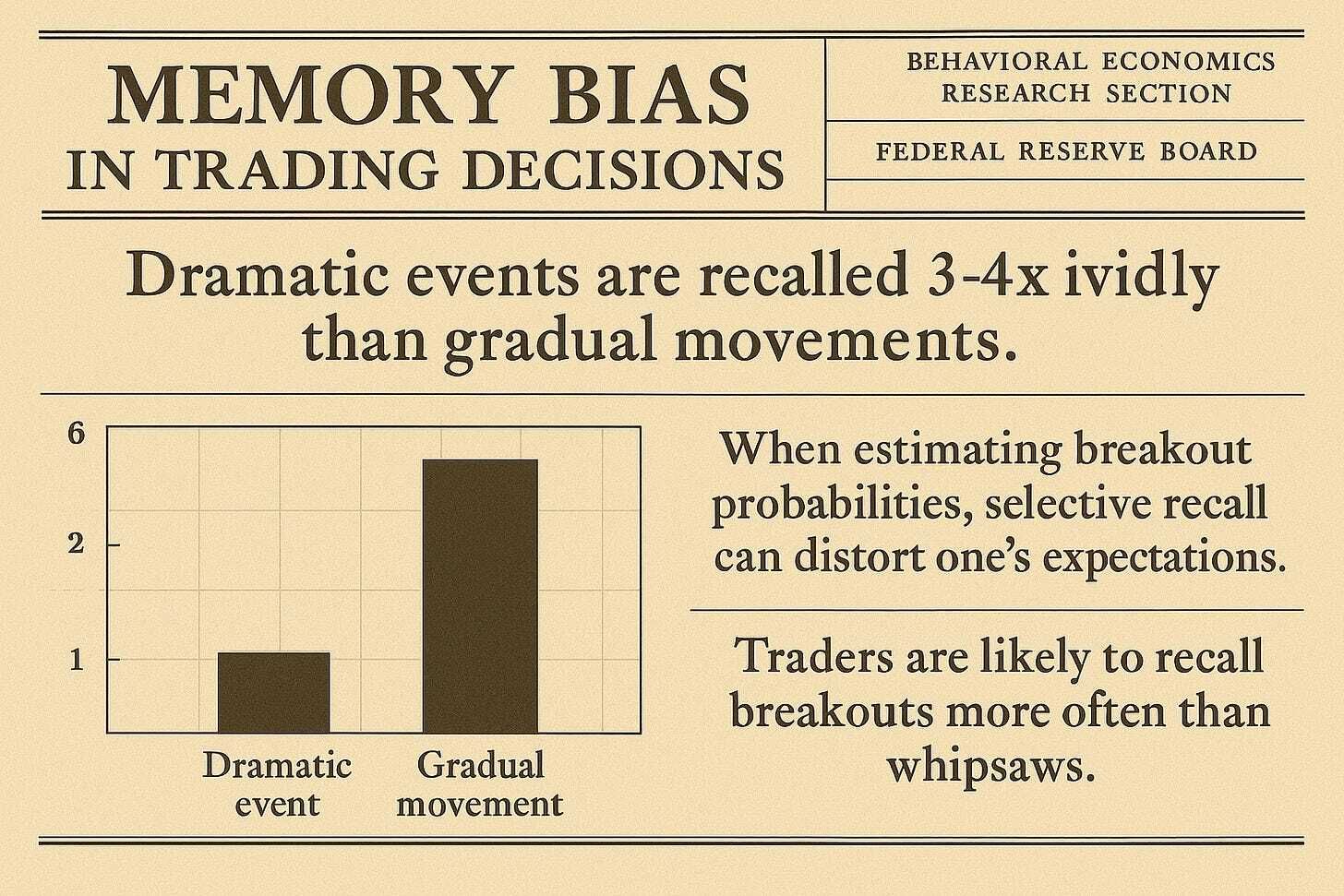

Inside day whipsaw behavior validates systematic patience over breakout speculation. When both directional biases get stopped out while theta decay continues working, time-based strategies often outperform direction-based approaches.

Theta decay creates profit potential regardless of market direction when positions are properly constructed. This time advantage allows systematic traders to benefit from sideways markets that frustrate directional speculators.

Clear PFZ levels provide mechanical decision points that remove emotional interpretation from systematic trading. When specific price levels define condition changes, discipline becomes simpler than discretionary judgment.

Fun Fact:

According to market research, since 1950, the U.S. stock market has been in a bull market 83% of the time. This statistical reality supports the systematic approach of maintaining consistent long-term positioning rather than trying to time market cycles, as the historical probability strongly favors upward movement over extended periods.

[Source: Strategic Wealth Partners – “My Two Favorite Stock Market Statistics”]

Trade well,

T2 Markets

p.s. Need help? Book a call with our team!

Reply