- Option Income Project

- Posts

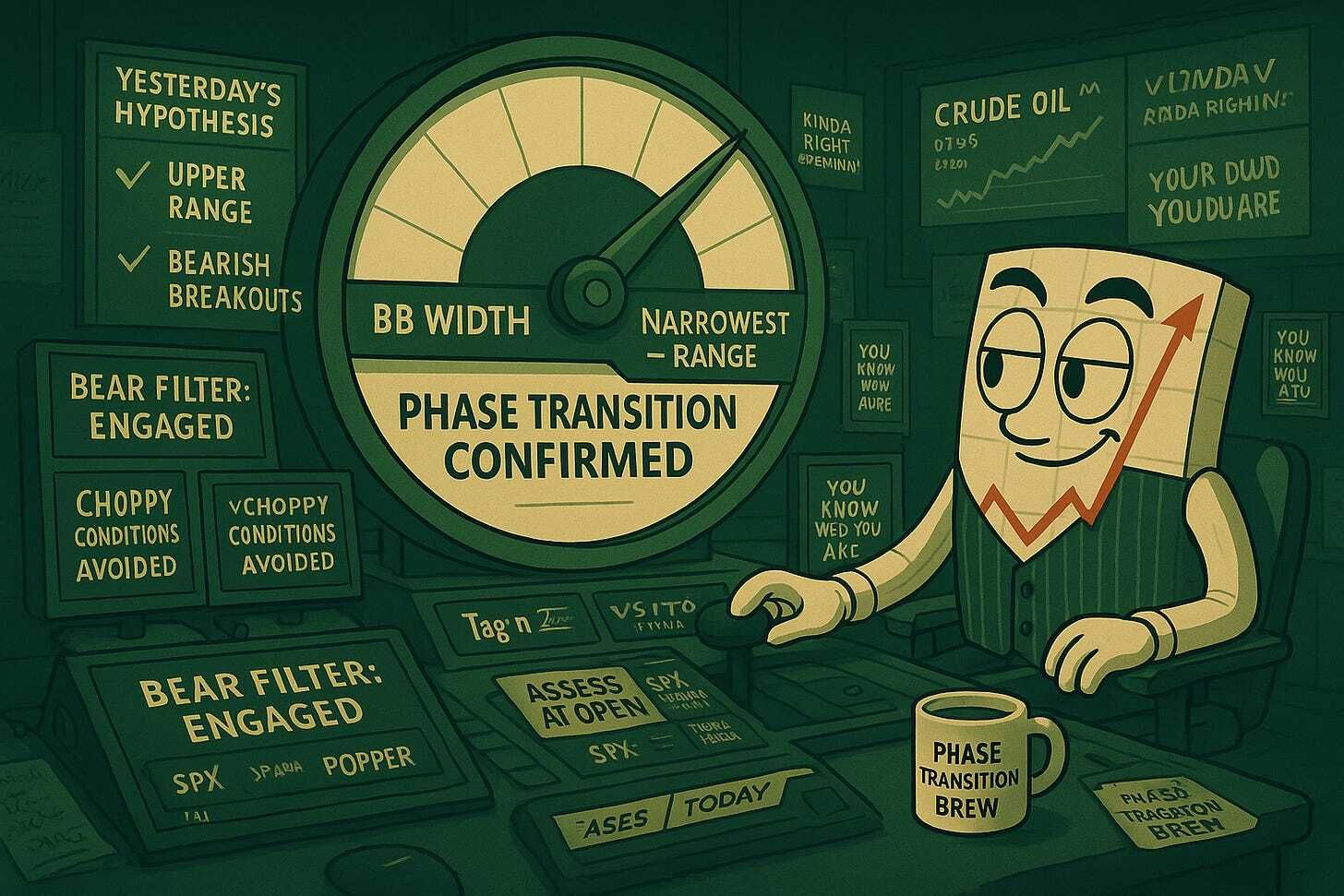

- Patience Paid. Bear Filter Worked. BB Width Confirms Range. Same View Today. | SPX Market Briefing | 2 Dec 2025

Patience Paid. Bear Filter Worked. BB Width Confirms Range. Same View Today. | SPX Market Briefing | 2 Dec 2025

Yesterday’s Hypothesis Of Upper End Of Range Paid To Be Patient Across All Strategies

Yesterday’s hypothesis of the bigger picture being at the upper end of the range on the main stock indexes certainly paid to be patient across all the strategies.

This is also something we dived deep on during our mentorship calls – not being too eager to think about a bull swing for those that needed one.

The Lazy Poppers and Premium Poppers – only thinking about the bear side of the trading as a filter – worked out perfectly to avoid choppy market conditions.

And one or two traders reported a cheeky little hybrid popper on the failed Premium Popper 1st breakout – well done – you know who you are

Thinking about today’s trading – it’s going to be much of the same.

Overnight futures have held yesterday’s lows with little overnight movement and as nothing new has happened or is developing then yesterday’s viewpoint holds true into today.

Crude Oil – CL – is at its upper range/channel highs – bear moves also make sense here until we see a breakout.

On the Income System layout – for both SPX and RUT the same analysis holds good – we are bullish until bearish. Although not looking for a new bullish position just yet.

SPX bear trigger below 6785.

RUT bear trigger below 2460.

Also I’m seeing that the Bollinger Band width has moved from its widest wide point and expanding (trend) to its narrowest narrow point and about to fire off an official range condition.

Confirming that the discretionary override on bulls may well have been the exact course of action to take as we transition from one phase of movement to another.

I shall again remain bearish on the popper setups and assess when the markets open.

Keep scrolling for the phase transition breakdown…

Patience Paid. Bear Filter Perfect. BB Width Confirms Phase Transition.

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

SPX Market Briefing:

Tuesday December continues yesterday’s upper range hypothesis (paid to be patient across all strategies),

The mentorship group focus on not being too eager for bull swings (lazy poppers and premium poppers bear filter worked perfectly,

cheeky hybrid popper on failed 1st breakout well done), today much of the same (overnight futures held yesterday’s lows, nothing new developing),

Crude Oil at upper range highs (bear moves make sense until breakout),

Income System bullish until bearish but not looking for new bullish position (SPX bear trigger below 6785, RUT bear trigger below 2460),

BB width moved from widest expanding to narrowest range condition (discretionary override on bulls confirmed correct as we transition phases), remaining bearish on popper setups.

Current Multi-Market Status:

SPX: Bull TnT active, bear trigger below 6785

RUT: Bull TnT active, bear trigger below 2460

ES: Held overnight lows

CL: Upper range highs – bear bias until breakout

GC: Consolidating

Patience Paid Yesterday

Yesterday’s hypothesis of the bigger picture being at the upper end of the range on the main stock indexes certainly paid to be patient across all the strategies.

Current Status: Patience validated, upper range hypothesis confirmed

Bear Filter Worked Perfectly

The Lazy Poppers and Premium Poppers – only thinking about the bear side of the trading as a filter – worked out perfectly to avoid choppy market conditions.

And one or two traders reported a cheeky little hybrid popper on the failed Premium Popper 1st breakout – well done – you know who you are

Current Status: Bear filter effective, hybrid poppers banking

Same View Today

Thinking about today’s trading – it’s going to be much of the same.

Overnight futures have held yesterday’s lows with little overnight movement and as nothing new has happened or is developing then yesterday’s viewpoint holds true into today.

Crude Oil – CL – is at its upper range/channel highs – bear moves also make sense here until we see a breakout.

Current Status: Yesterday’s viewpoint holds, no new developments

Income System Status

On the Income System layout – for both SPX and RUT the same analysis holds good – we are bullish until bearish. Although not looking for a new bullish position just yet.

SPX bear trigger below 6785.

RUT bear trigger below 2460.

Current Status: Bullish but not adding, bear triggers defined

BB Width Phase Transition

Also I’m seeing that the Bollinger Band width has moved from its widest wide point and expanding (trend) to its narrowest narrow point and about to fire off an official range condition.

Confirming that the discretionary override on bulls may well have been the exact course of action to take as we transition from one phase of movement to another.

I shall again remain bearish on the popper setups and assess when the markets open.

Current Status: BB width confirms range phase, discretionary override validated

Expert Insights

The Observation: Bollinger Band width tells you what phase the market is in.

Widest and expanding = trend.

Narrowest and contracting = range.

The transition between wide to narrow phases is where most traders get chopped up.

The Fix: Watch the BB width, not just price. When you see width moving from expansion to contraction, shift your approach. Yesterday’s discretionary override on bull setups wasn’t a guess – it was reading the phase transition.

Its a good job we have a dedicated custom tool to highlight these phases.

Fun Fact:

December’s historical trading behaviour is oddly split – the second half of the month crushes the first half. Since 1950, the S&P 500’s returns during the first half of December are significantly lower than the second half, with the odds of any day moving higher much better in the latter portion.

[Source: StockCharts / Tom Bowley – “December Historical Tendencies”]

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply