- Option Income Project

- Posts

- Opinions Are Like A*Holes. NATHs Are Like Proof. | SPX Market Briefing | 7 Jan 2026

Opinions Are Like A*Holes. NATHs Are Like Proof. | SPX Market Briefing | 7 Jan 2026

Premium Poppers Crushing It. Swings Still Swinging. System Still Paying.

Yesterday’s expected quiet day turned out to be a complete dud.

Just goes to show – opinions are like a*holes. Everyone’s got one and they’re usually full of shit.

Seriously though, I’ve seen this large wick phenomenon turn out to be true more times than it’s wrong. I’m curious now – especially since I have fast access to coding scripts and greater research capabilities than I previously had. I may run a study to look at the probabilities of “wick today, narrow range tomorrow” likelihood.

Anyway, that’s a tomorrow thing. Another item on my always-growing research list.

Let’s think about making money.

Your predictions don’t pay the bills. Your setups do. Scroll down.

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

Market Briefing:

Multi-Market Snapshot

The swings are swinging. Still bullish.

RUT – The Straight Line Higher

Uncle Russell moved in a straight line yesterday.

No hesitation.

No pullback.

Just up.

And now it’s hugging the upper Bollinger Band with band expansion visible on the band width indicator.

You know what that typically means? Trend continuation.

A run to new all-time highs could well be on the cards.

The TnT swing is working.

The band expansion is confirming.

NATHs are within reach.

SPX – Following Along

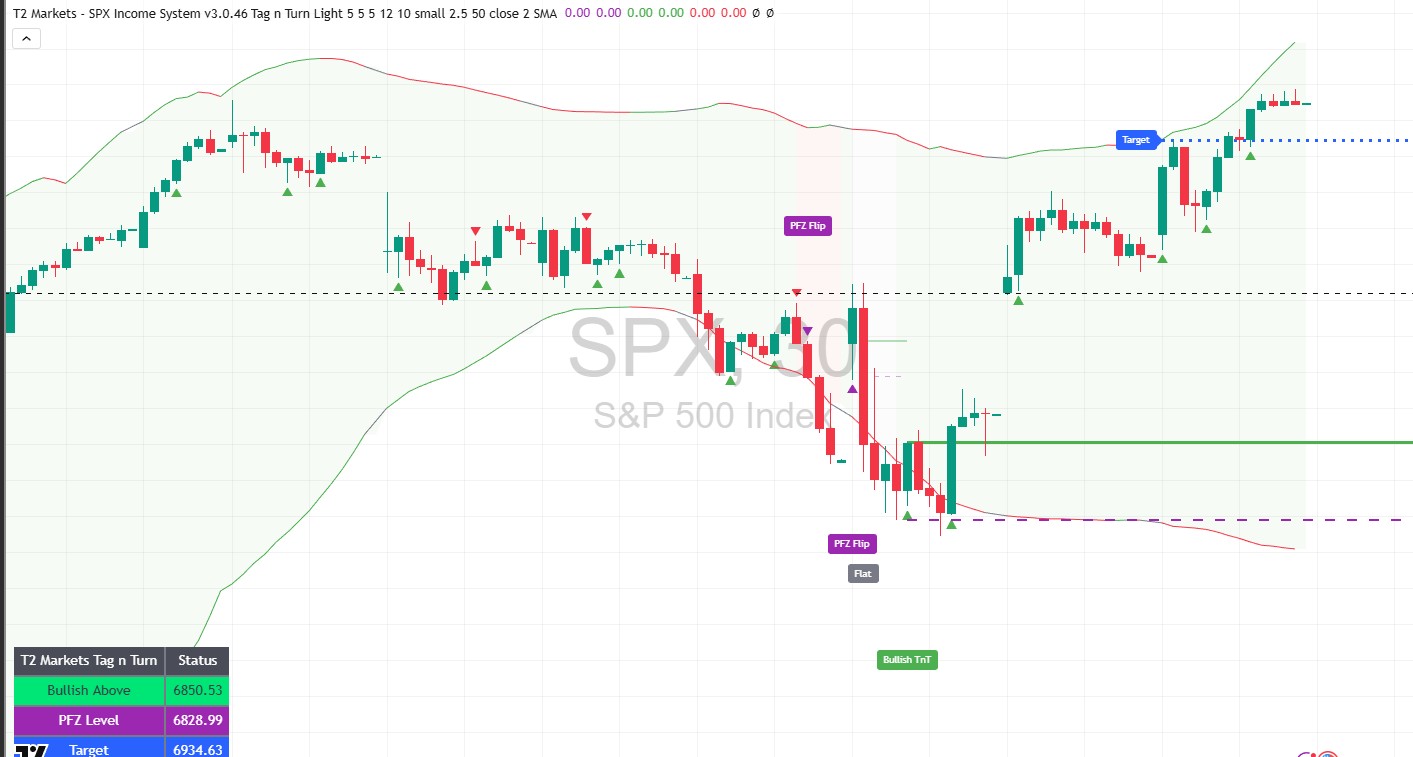

SPX is bullish above 6850.53 with target at 6934.63. Currently sitting at 6948.69 – which means we’re pushing through target territory and into new all-time high territory.

Dow – First to Pop

The Dow was first to pop its “new year new me” cherry. New all-time highs already printed. Leading the charge.

The Premium Poppers are absolutely crushing it at the open.

Again!

Yesterday was no exception.

The system keeps delivering regardless of what I think the market will do.

That’s the entire point.

The Tag n Turn swings are just waiting for the next action point. The Premium Poppers are just waiting for the markets to open.

PopPop.

News I’m NOT Watching Today!

ADP Employment at 8:15am – Forecast 47K. This sets the tone for Friday’s NFP.

ISM Services PMI at 10:00am – Forecast 52.3. Services sector health check.

JOLTS Job Openings at 10:00am – Forecast 7.65M. Labor market demand.

Data-heavy day. Could create volatility. Could create setups.

News I’m NOT Watching This Week!

Wednesday and Friday are the heavy days. Today’s triple data drop could move markets.

Looking Ahead

Yesterday I expected nothing and got 119% ROC.

Today I’m expecting… well, I’ve learned my lesson about expectations.

The swings are bullish. RUT is hugging the upper band with expansion. Dow’s already at NATHs. SPX is pushing through targets.

The Premium Poppers will fire at the open regardless of what I think.

That’s the system. That’s the point.

PopPop.

Fun Fact:

The “Walk the Bands” Phenomenon

During strong trends, price doesn’t just touch the Bollinger Bands – it hugs them. This is called “walking the bands” and it’s one of the most reliable trend continuation signals.

According to John Bollinger himself, when price consistently closes in the upper half of the bands during an uptrend, it’s a sign of underlying strength, not overextension. The bands are designed to contain approximately 95% of price action – when price persistently pushes against one side, it indicates directional conviction.

The common mistake? Assuming a touch of the upper band means “overbought.” In trending markets, it often means “strong and getting stronger.”

RUT is walking the bands right now. History suggests it continues until something breaks the pattern.

[Source: Bollinger on Bollinger Bands – John Bollinger]

++++++++++

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply