- Option Income Project

- Posts

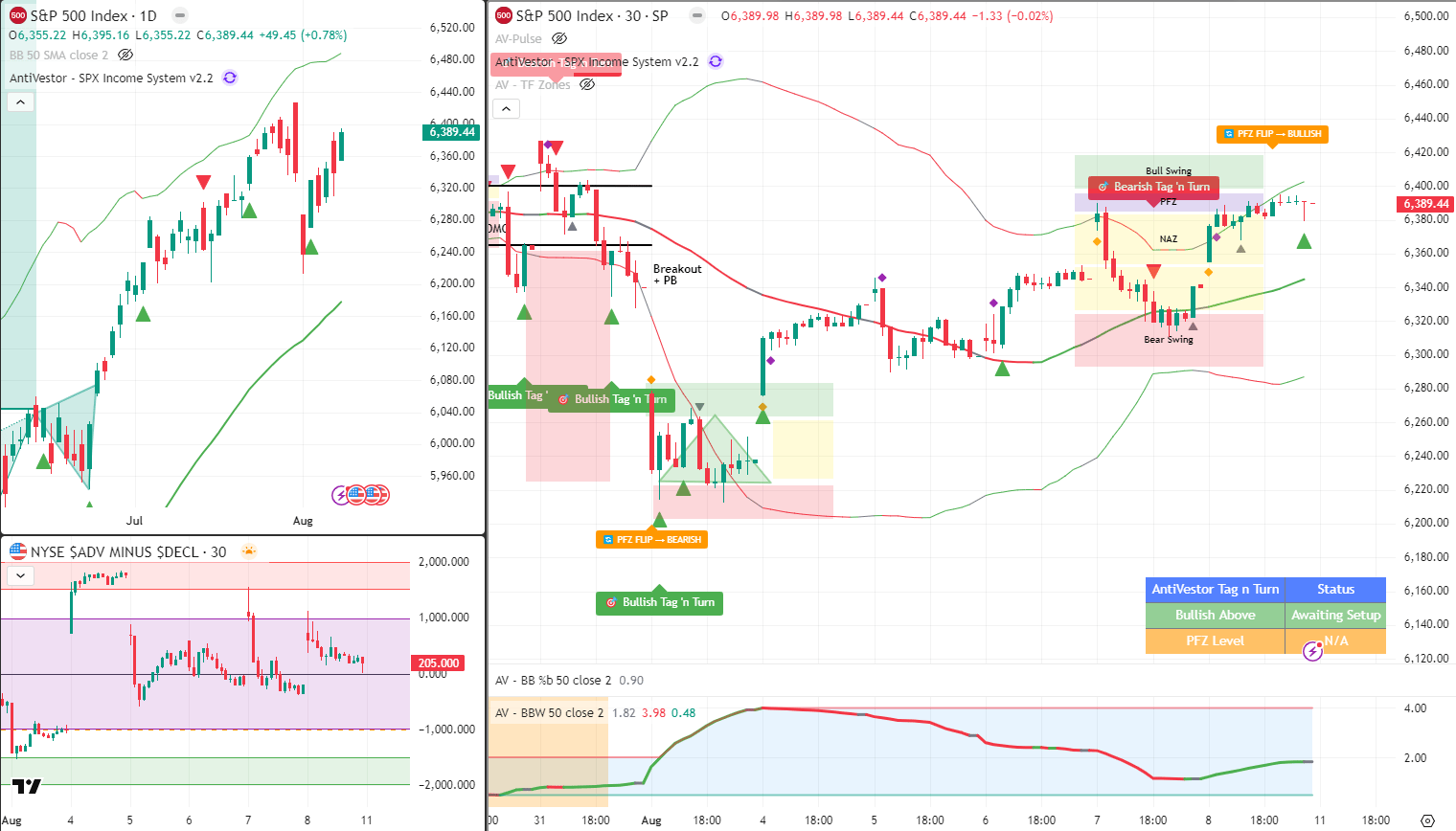

- Bulls Tag the Zone. Bears Still Hunting the Turn

Bulls Tag the Zone. Bears Still Hunting the Turn

SPX Analysis 11 Aug 2025

Hi traders!

Well, well, well. Just when you think you’ve got your bear costume fitted and your short thesis polished, SPX decides to play musical chairs with the bias.

One minute we’re eyeing downside continuation, the next minute the software’s flashing green “Tag ‘n Turn – Bullish Above” like a neon sign at a 24-hour diner.

August has been absolutely smashing it for our trading crew.

The Wall of Wins is growing fast, and the students are stacking victories like they’re collecting Pokemon cards. Back-to-back wins, mechanical setups, and that satisfying “bingle-bong” of premium collection.

But here’s the thing about this game – just when you think you’ve got the script memorized, the market rewrites the ending.

The Tag ‘n Turn software has finally locked onto a clean setup.

Price tagged the zone, and now we’re waiting for the turn.

It’s like fishing with sonar – you know exactly where the fish are, you just need them to bite.

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX Market Briefing:

Looking at the chart, we’ve got a classic case of “hurry up and wait.”

The Tag ‘n Turn system delivered a fresh setup last week – and the software is marking those levels with surgical precision. No more guessing, no more “approximately here-ish.” The zone is tagged, the levels are locked, and now we wait for price to do what it does best: deliver the goods to patient traders.

The overnight futures are flatter than yesterday’s soda.

No major gaps, no overnight drama, just that steady hum of a market taking a breath before the next move.

Today’s Triple Threat Plan:

Tag ‘n Turn Setup – The main event. Price has tagged the zone, software confirms the levels, now we wait for the setup to complete. This isn’t about forcing trades; it’s about being ready when the market serves up the opportunity on a silver platter.

Premium Popper – Opening bell scalp. First 30-60 minutes often serve up fast setups for quick premium collection. Get in, get the edge, get out.

Lazy Popper – The endgame play. Set it up, let time decay do the heavy lifting, and collect at the bell. Sometimes the best trades are the ones you forget you’re in.

The beauty of having multiple setups in the quiver is that you’re never forcing anything.

Market wants to give you a scalp?

Take it.

Wants to set up a swing?

Be ready.

Wants to hand you premium decay?

Say thank you and collect.

…oh and your all done in the first hour no matter which one you trade.

August momentum is real, and the students are proving it trade by trade. When the setups align and the system fires, magic happens.

In Other News…

Pre-Market Mood: “Don’t Jinx It” Edition

1) 03:05 ET – The ‘Just a Sip’ Rally

Futures are tiptoeing like they don’t want to wake the bond market. S&P 6,378 +0.07%, Nasdaq +0.11%, Dow +0.06%. Overnight ranges tighter than a CFO’s bonus budget (<0.3%). Thursday’s close was a lukewarm cocktail, and early trade feels like a polite “hello” rather than a champagne pop.

2) Rotation – Oil Trips, Transports Order Dessert

Energy is leading the losers as crude aims for a 4-5% weekly pratfall. This is music to transports and rate-sensitives — cheaper fuel and a softer dollar could mean actual smiles. Japan’s rally props up tech’s ego, but the rest of Asia’s giving it the “good luck with that” side-eye.

3) Earnings & Events – Goodyear at 08:30, Tariff Bingo Ready

Headliners: Goodyear’s earnings call and a grab-bag of small-cap reports. Watch for CEOs to slip “tariff,” “freight,” and “FX headwind” into the same sentence — the corporate earnings equivalent of a triple-word score.

4) Cross-Asset Nuance – Rate-Cut Cosplay & Gold’s Policy Glow-Up

Miran’s nomination + Waller whispers = traders pulling out the rate-cut champagne early. JPMorgan’s dreaming of four trims from September. Softer dollar is tucking metals into bed, while gold struts in wearing a “Tariff Boost” sash and a smug grin. Barring any economic data plot twist, the stage stays set for a September rate-cut romance.

TL;DR:

Markets are coasting on hope, caffeine, and a soft dollar. Oil’s on the floor, gold’s at the after-party, and rate-cut groupies are already lining up for September. Handle this optimism like it’s nitroglycerin in a paper cup.

Expert Insights:

The Tag ‘n Turn system’s accuracy comes from Bollinger Band bandwidth compression followed by expansion. When the bands tighten, volatility coils like a spring. When they expand, that energy releases in measured, tradeable moves.

The software removes the guesswork by marking precise entry and exit zones based on bandwidth percentiles. No more “looks about right” – just mathematical precision applied to market chaos.

Patient traders win because they wait for the setup to come to them, not the other way around.

Fun Fact:

In August 1982, the S&P 500 began what would become the greatest bull market in history, gaining over 228% by August 1987. The rally started with a simple technical breakout above resistance – proving that sometimes the biggest moves begin with the smallest signals.

[Source: Yahoo Finance – “The Great Bull Market of 1982-1987”]

Trade well,

T2 Markets

Need help? Book a call with our team!

Reply