- Option Income Project

- Posts

- Let the Shenanigans Begin: ATH Meets Month-End, Ranges Compress | SPX Market Briefing | 29 Aug 2025

Let the Shenanigans Begin: ATH Meets Month-End, Ranges Compress | SPX Market Briefing | 29 Aug 2025

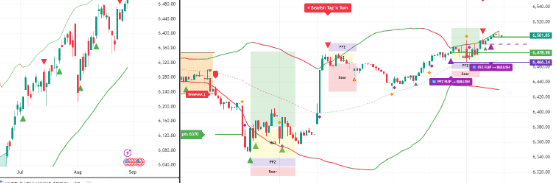

Tag ‘n Turn Whiplash: Manual Trading Benefits vs Algo Flip-Flopping

Let the shenanigans begin…

Last Friday of month, last day of month is here, and how fast time flies… could be an age and perspective thing, but who knows.

The calendar convergence we’ve been expecting has arrived with all the systematic predictability of month-end positioning chaos. New all-time highs AND month-end nonsense could make for interesting market behavior, though “interesting” in trading often means “frustratingly compressed” rather than “profitably exciting.”

SPX prices are already compressing intraday with super low range movements. The main move of the day is being done briefly at some point early on or late on in the day. Classic month-end behavior – everything squeezed into narrow windows while the rest of the session meanders sideways.

Nothing to be done about it except recognize that it’s frustrating, follow your trading plan, and move on.

Keep scrolling for manual vs algo wisdom and range compression reality…

Most Trade SPX Blind. You’ll Trade It Like You Designed It.

Pulse bars flip the lights on. You see it. Trade it. Bank it.

Unlock the SPX Strategy!

SPX Market Briefing:

The charts perfectly illustrate why systematic patience beats reactive positioning, especially when month-end compression meets algorithmic whiplash conditions.

Current System Status:

Tag ‘n Turn Swing: Bullish (manually maintained through algo flip chaos)

Range Compression: Active – early/late moves only

Month-End Effect: Full activation with expected low intraday ranges

Manual Override: Proving beneficial vs algorithmic flip-flopping

BnB Trade: Wednesday entry closed profitably Thursday

The Tag ‘n Turn Manual vs Algo Lesson:

This is where manual trading may just benefit compared to the algo conditions. While the algorithms are technically correct, simply not being in a rush to do anything comes out winning again.

Yesterday, the system got bearish and then flipped back bullish –

The net result? I didn’t go from bullish to bearish and back to bullish. Sometimes the best trade is the one you don’t make when the signals are too close together.

I’ll think of a suitable way for the software to handle this whiplash scenario, but manually we keep doing what we’re doing – when setups are so close together, it’s best to stay where we are and not get turned around by technical noise.

Yesterday’s Mixed Results Reality Check:

I also had a BnB trade from Wednesday which closed profitably on Thursday, so all is not bad. This perfectly illustrates why systematic approaches work across multiple timeframes – when one setup struggles, another delivers.

Premium Popper & Lazy Popper Update: Yesterday’s Premium Popper was close to an exit for me, and many didn’t get an entry due to speed of movement. I got a wee bit lucky on my fill – or unlucky, as it turned out we needed a drop of red ink for the ledger.

The Lazy Popper didn’t get going before it timed out for a no trade. Sometimes the market simply doesn’t provide the conditions your systems require, and that’s perfectly acceptable systematic behaviour.

Today’s Away-from-Desk Philosophy: Today’s setups just await the algo firing off a setup. I am again enjoying life and away from the desk today, so I will once again pick one and be done with the day.

This lifestyle integration remains one of the greatest benefits of truly systematic approaches – the ability to engage selectively rather than obsessively.

In Other News…

Futures achieving peak boredom

ES crawled to +0.05% by 6:20 AM like Percy attempting small talk at the office party. NQ managed +0.07% while YM sat perfectly flat at 0.00% – collectively displaying less excitement than Wallie discovering mandatory training modules. Tight overnight ranges as traders apparently decided watching paint dry was more thrilling than actual trading.

Energy finds a pulse while tech has identity crisis

Crude oil bouncing back like Mac after discovering the premium coffee machine works again, dragging energy stocks along for a victory lap. Tech sector splitting personalities harder than a divorce proceeding – semiconductors under pressure while cloud names creeping modestly green like shy flowers in spring. Banks flatter than Kash’s enthusiasm for compliance training.

Earnings confessional delivers mixed verdicts

Salesforce beat top-line expectations last night, shares jumping +3% after hours because apparently enterprise software still has a pulse. Ulta Beauty slashing full-year outlook, shares diving -4% as beauty spending apparently has limits even among the cosmetically obsessed. Gap raising guidance on improved traffic, proving people will still buy overpriced denim regardless of economic uncertainty.

Cross-asset meditation continues

Dollar index flexing to 98.2 while ten-year yield dipped to 4.27% like it’s reconsidering its life choices. Brent climbing to $67.4, WTI at $62.9 – oil prices showing more ambition than most politicians’ campaign promises. Gold sitting pretty at $3,335, VIX ticking down to 13.3 because apparently even volatility finds this market therapeutically boring.

Expert Insights:

Month-end compression typically creates conditions where early morning or late afternoon provide the only meaningful directional moves, with midday sessions offering minimal range expansion. Systematic traders benefit from recognizing these patterns rather than forcing activity during compressed periods.

Manual override capabilities become valuable when algorithmic conditions create whipsaw scenarios with rapid signal reversals. The key is distinguishing between legitimate technical changes and noise-based flip-flopping that benefits from patient positioning.

Multi-timeframe systematic approaches provide natural hedging when shorter-term setups encounter difficult conditions. Wednesday’s BnB trade closing profitably on Thursday demonstrates how patient positioning across different timeframes creates portfolio stability.

Fun Fact:

According to research from the Trade That Swing analysis of seasonal patterns, August has historically been one of the worst months for the S&P 500 over the last 20 years (2005-2024), consistently ranking among the worst performing months alongside January, June, and September. This makes the recent new all-time highs during late August particularly notable from a seasonal perspective.

[Source: Trade That Swing – “Best and Worst Months for the Stock Market – Seasonal Patterns”]

Trade well,

T2 Markets

p.s. Need help? Book a call with our team!

Reply