- Option Income Project

- Posts

- Gold Smashes $5,000. Indexes Gap Lower. January’s Final Week Sets the Tone | SPX Market Briefing | 26 Jan 2026

Gold Smashes $5,000. Indexes Gap Lower. January’s Final Week Sets the Tone | SPX Market Briefing | 26 Jan 2026

3 Indexes Hit Gap Fill Resistance. Bears Roll Into Monday. Now What?

Remember last week when we talked about the bears pulling you back in Godfather style?

Well, they weren’t joking.

Monday opens with gold smashing through $5,000 like it’s got somewhere important to be, whilst the indexes gap lower and confirm what the price action was whispering all last week: the bear might actually be the story here.

Three of the four major indexes hit their gap fill levels and said “nope, this is resistance now.” The one that didn’t? Already in bear mode anyway.

And if that wasn’t enough uncertainty for your Monday morning coffee, we’ve got Fed Wednesday, Tesla Wednesday, three other Mag 7 reports, and a 76% chance of government shutdown all converging into one glorious mess of a week.

January’s final week. The tone-setter for 2026. Buckle up.

Scroll down for the systematic breakdown – including why last week’s flat position was the smartest move on the board…

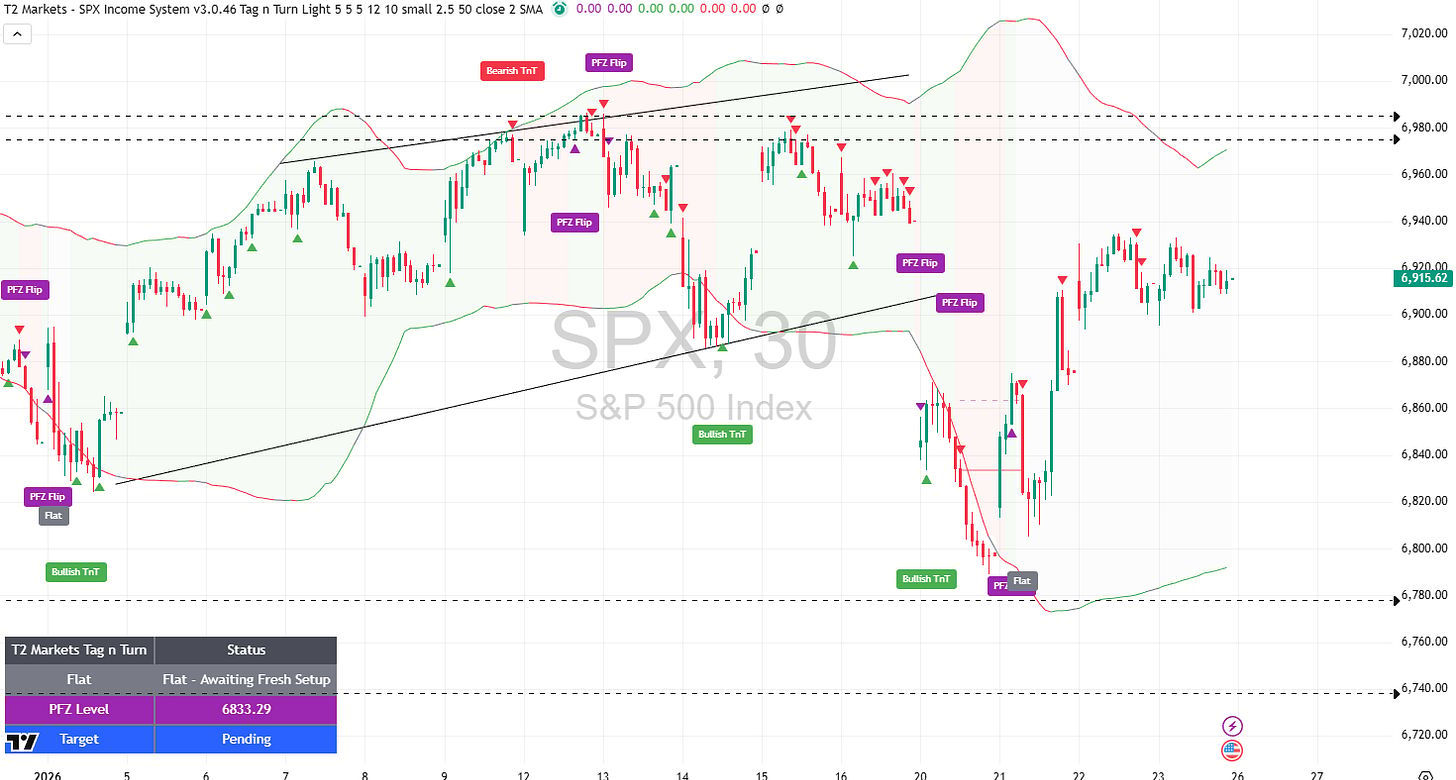

SPX. 30 Minutes. One Trade. Job Done.

Trade less. Profit more. This isn’t trading… it’s income engineering.

Market Briefing:

SPX: Flat – Awaiting Fresh Setup. PFZ Level at 6833.29. Target pending. Last week’s restraint proved correct – the flip-flopping resolved into flat, and the discretionary V-shaped entry got managed with the AVWAP leash. No fresh signal yet. Patience rewarded.

RUT: Bearish Below 2727.88. PFZ Level 2735.1. Target 2628.8. Uncle Russell is breaking back into the larger range after tagging all-time highs last week. Classic “touch the ceiling, fall back through the floor” behavior. Bears firmly in control.

ES Futures: 6,890 pre-market, down 0.3%. Gap lower from Friday’s close. Testing the gap fill resistance that held last week.

NQ Futures: 23,400 pre-market, down 0.4%. Weakest of the bunch, as expected. Still leading the bear charge.

YM Futures: Below the 49,244 level. Gap fill resistance held. Following the herd lower.

Gold: RAMPAGE MODE. Broke $5,000. Silver topped $100. Platinum at 2007 highs. Safe haven demand is screaming. This is the flight-to-quality trade in full effect.

VIX: 16.09 – steady but elevated. Not panicking, but not complacent either.

Dollar: Worst week in seven months. Weakness supporting commodities and gold’s surge.

The Gap Fill Story

Here’s what last week set up and this week is confirming:

Three of the four major indexes – ES, YM, and NQ – rallied to their gap fill levels from earlier in the week. Classic “fill the gap then reverse” behavior. The market checked its work, decided it didn’t like what it saw, and is now heading back down.

Why Flat Was Right

Last week’s SPX analysis called for restraint. The system flip-flopped between bull and bear, eventually settling on flat. The discretionary V-shaped entry got managed with the rising AVWAP as a leash.

Result? No unnecessary losses from getting whipsawed. No premature positions that would be underwater this morning. The hedge locked in a small profit potential.

Sometimes the best trade is the one you don’t take.

This week, we wait for the fresh setup. PFZ level at 6833.29 gives us our line in the sand. Until the system generates a clear signal, flat is the position.

The January Tone-Setter

Here’s the thing about this week that makes it more significant than just another Monday:

January’s final week often sets the tone for the year.

If bears maintain control through month-end, it establishes a narrative. If bulls stage a late-month recovery, different story entirely. The RUT breaking back into its range after touching all-time highs is particularly telling – that’s not bullish behavior, that’s distribution.

Watch what happens by Friday. Not for prediction purposes – we don’t do that here – but for context on what systematic setups might dominate Q1.

The Earnings Thunderdome

This week isn’t just about technicals. We’ve got a fundamental gauntlet:

Mag 7 Reports:

Tesla (Wednesday) – Expected -40% EPS decline. Elon’s been busy with other things.

Microsoft (Wednesday) – Expected $3.88 EPS (+20.1%). AI spending scrutiny.

Meta (Thursday) – Expected $8.15 EPS (+1.6%). Metaverse losses in focus.

Apple (Thursday) – Expected $2.67 EPS (+11.3%). iPhone China concerns.

Other Heavyweights: Caterpillar, Boeing, GM, Starbucks, Visa, Mastercard, American Express.

102 S&P 500 members reporting this week. Peak earnings season.

Through Friday, 64 members reported with 82.8% beating EPS estimates. Sounds good, right? Except Intel beat estimates and dropped 17%. Guidance matters more than actuals in this market.

The Triple Uncertainty Stack

As if earnings weren’t enough:

Fed Decision Wednesday: Hold expected. But it’s the language that matters. Any hint of hawkishness with gold at $5,000 and dollar weakness could create fireworks.

Shutdown Odds 76%: Government funding deadline approaching. Markets have seen this movie before, but the timing with everything else adds to the uncertainty stack.

Geopolitical Backdrop: Gold’s $5,000 break signals extreme safe-haven demand. Iran tensions supporting oil at $61 despite oversupply warnings. Dollar’s worst week in seven months. The flight-to-quality is real.

The Intel Warning

Friday’s 17% Intel collapse deserves attention. Not because we trade Intel, but because of what it represents:

Beat earnings estimates

Tanked on guidance

Erased 50% of year-to-date gains in a single session

This is a market that punishes future uncertainty regardless of present performance. Keep that in mind as we head into Mag 7 week. Tesla’s -40% expected decline is already priced in. What happens if the guidance is worse?

Fun Fact:

Gold’s $5,000 Milestone in Context

Gold breaking $5,000 represents a doubling from its March 2024 levels when it first crossed $2,500. The current surge is driven by central bank buying (China, Russia, India), dollar weakness (worst week in seven months), and geopolitical uncertainty (Iran tensions, Greenland situation).

Silver simultaneously breaking $100 and platinum hitting 2007 highs suggests this isn’t just gold-specific demand – it’s a broad precious metals flight-to-safety that typically precedes periods of elevated market uncertainty.

The last time all three precious metals hit multi-year or all-time highs simultaneously was late 2010, preceding the 2011 debt ceiling crisis.

[Source: Precious metals historical data – multiple reporting sources]

Meme of the Day:

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply