- Option Income Project

- Posts

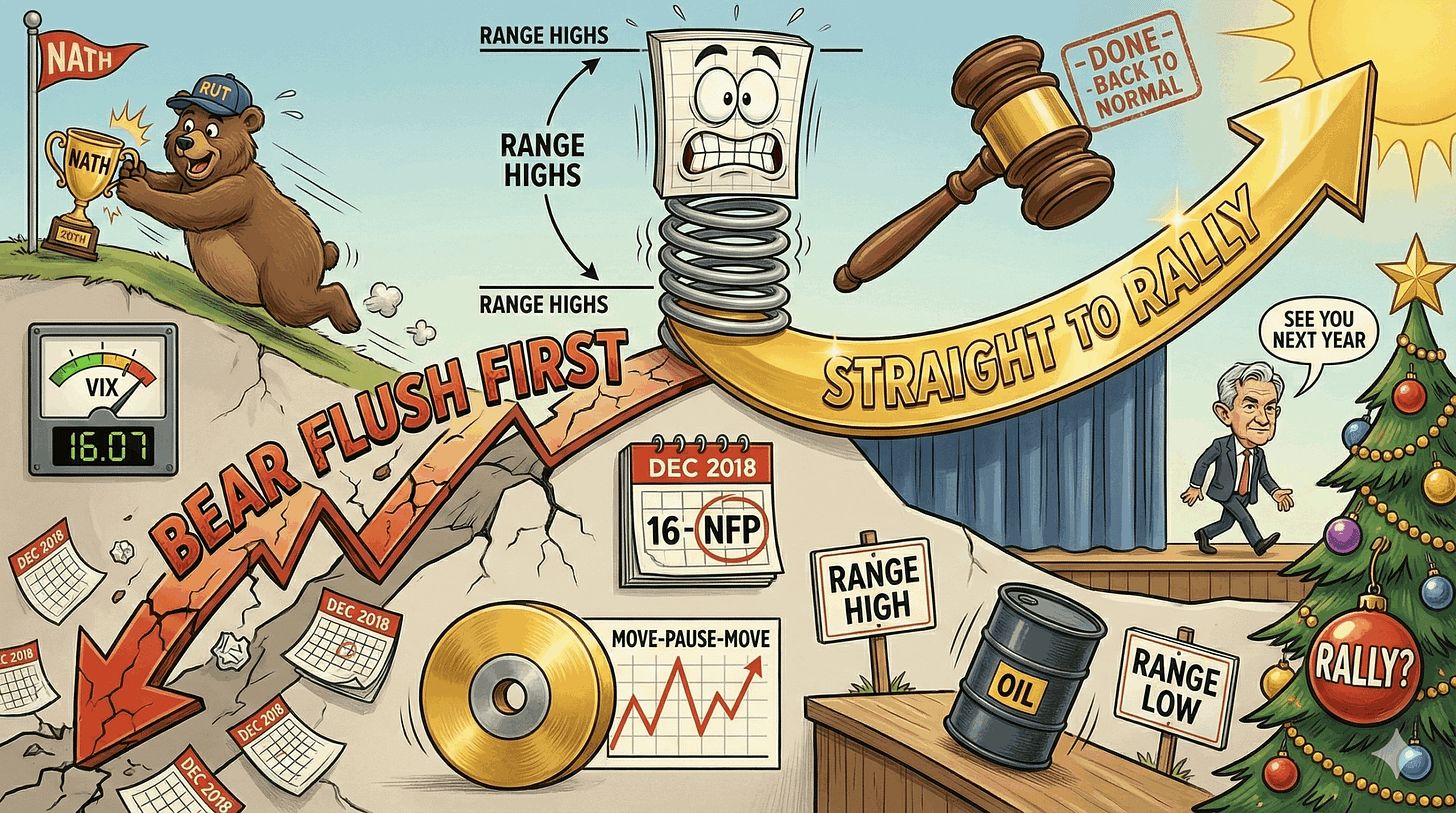

- FOMC Wibble Wobble Done. Markets Coiled. Which Way Will They Pop? | SPX Market Briefing | 11 Dec 2025

FOMC Wibble Wobble Done. Markets Coiled. Which Way Will They Pop? | SPX Market Briefing | 11 Dec 2025

FOMC Came And Went With Uncle Russell Making A NATH Guest Appearance

Despite the FOMC wibble wobble yesterday and a NATH guest appearance on Uncle Russell – the markets didn’t really do anything new.

The overnight futures have reclaimed most of yesterday’s gains on S&P and Nasdaq, and partially on Dow and Russell. Back to square one then.

No Premium Poppers or trading at all for me yesterday for what I hope are obvious reasons. FOMC day. Sitting on hands was the play.

Looking for a few Premium Poppers at or near the opening bell today.

Keep scrolling for why I’m leaning bearish before the Christmas rally…

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

Market Briefing:

Current Multi-Market Status:

SPX: Bullish Above 6849.59, PFZ 6824.69, Target 6884.2 – at range highs, potential bear setup forming

RUT: Bearish Below 2560.11, PFZ 2576.31, Target 2510.17 – bear signal on last bar

VIX: 16.07 – calmed down post-FOMC

GC: 4,246.9 – chugging along, move pause move pause

CL: 57.55 – back to range highs to range lows (6 Money Making Patterns)

ES: 6,856.25

NQ: 25,608.75

The Coiled Spring

I still get the feeling the markets as a whole are going to pop.

It’s really just a case of which way and how hard.

Will we get a bear flush like we did in 2018 around this time before the Christmas rally? NFP catch up on the 16th from the shutdown – could this trigger things?

My own view is that I’m leaning towards a bear move first before we see the Christmas rally. Just my opinion!

SPX – Range Highs, Bear Setup Forming

SPX has moved from the range lows to the range highs and we are just about to potentially see a new bear setup.

The software is showing Bullish Above 6849.59 with the flip point (PFZ) at 6824.69. Target remains 6884.2.

Watch for the bear trigger.

RUT – Already Did The Work

RUT broke through the highlighted range – smashed its way post-news to target and is now giving the bear signal on the last bar of yesterday.

Nothing to do with this until the markets open. The signal came on the close. We wait for confirmation at the open.

Bearish Below 2560.11, PFZ 2576.31, Target 2510.17

Crude Oil – 6 Money Making Patterns In Action

Crude oil is back to moving from the range highs to the range lows. One of my 6 Money Making Patterns in action.

This is what systematic trading looks like – identify the pattern, execute the setup, bank the profits. Rinse and repeat.

Gold – Chugging Along

Gold is just chugging along. Move. Pause. Move. Pause.

Nothing exciting but nothing to complain about either.

Calendar Today

8:30am: Initial Jobless Claims

8:30am: PPI (Forecast 0.2% vs Previous 0.2%)

8:30am: Core PPI (Forecast 0.2% vs Previous 0.3%)

Upcoming: NFP catch up on December 16th from the shutdown delay.

Expert Insights:

Markets coiled at range boundaries, leaning bearish before Christmas rally – 2018 comparison.

December 2018 provides the perfect template for what Phil is anticipating. That December was the worst since 1931, with the S&P 500 losing nearly 10% of its value. Christmas Eve 2018 saw major indexes fall another 2% as markets reeled from Fed rate hikes and trade tensions.

But then came the reversal – December 26th saw the Dow add over 1,000 points in the biggest post-Christmas rally in stock market history.

The lesson? The Santa Claus rally (traditionally the last five trading days of December and first two of January) occurs approximately 80% of the time since 1950 according to the Stock Trader’s Almanac – but it doesn’t mean the path there is smooth. Sometimes the flush comes first.

[Source: CME Group OpenMarkets – “The History of the Santa Claus Rally”]

Fun Fact:

The 2018 Template: Sometimes The Flush Comes First

December 2018 was the worst December since 1931 – then came the biggest post-Christmas rally in stock market history!

Here’s the uncomfortable truth about Christmas rallies that the permabulls don’t want you to hear: sometimes the market needs to puke before it parties!

December 2018 saw the S&P 500 lose nearly 10% of its value in the worst December since the Great Depression. Christmas Eve 2018? Major indexes dropped another 2% while Trump tweeted about the Fed being “like a powerful golfer who can’t score because he has no touch.”

Absolute carnage. But then December 26th arrived and the Dow added over 1,000 points – the biggest post-Christmas rally in stock market history. The Santa Claus rally period (last 5 trading days of December, first 2 of January) still occurs about 80% of the time since 1950, but the path there isn’t always pretty.

So when I say I’m leaning bearish before the Christmas rally? I’m not being a Grinch. I’m just reading the historical playbook. Bear flush first, then rally. Just my opinion!

[Source: CME Group OpenMarkets ]

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply