- Option Income Project

- Posts

- Flipping Done. Bear Swing Forming. Upper Boundary Rejected. | SPX Market Briefing | 14 Jan 2026

Flipping Done. Bear Swing Forming. Upper Boundary Rejected. | SPX Market Briefing | 14 Jan 2026

One of My 6 Money Making Patterns: Upper Range → Lower Range.

After a wee bit of flipping and flopping as we toy with the new all-time highs, a decision seems to have been made. We are now looking at what could (finally) be the bear swing.

As you can see on the daily charts, we also seem to have banged right up against the upper boundary levels of the consolidation zone we updated on Monday’s group calls.

Nasdaq is leading the bear charge – having not even participated in the recent bull moves.

And this is typical.

One of my 6 Money Making Patterns: when we’re at the upper end of the range, price is expected to move to the lower end of the range.

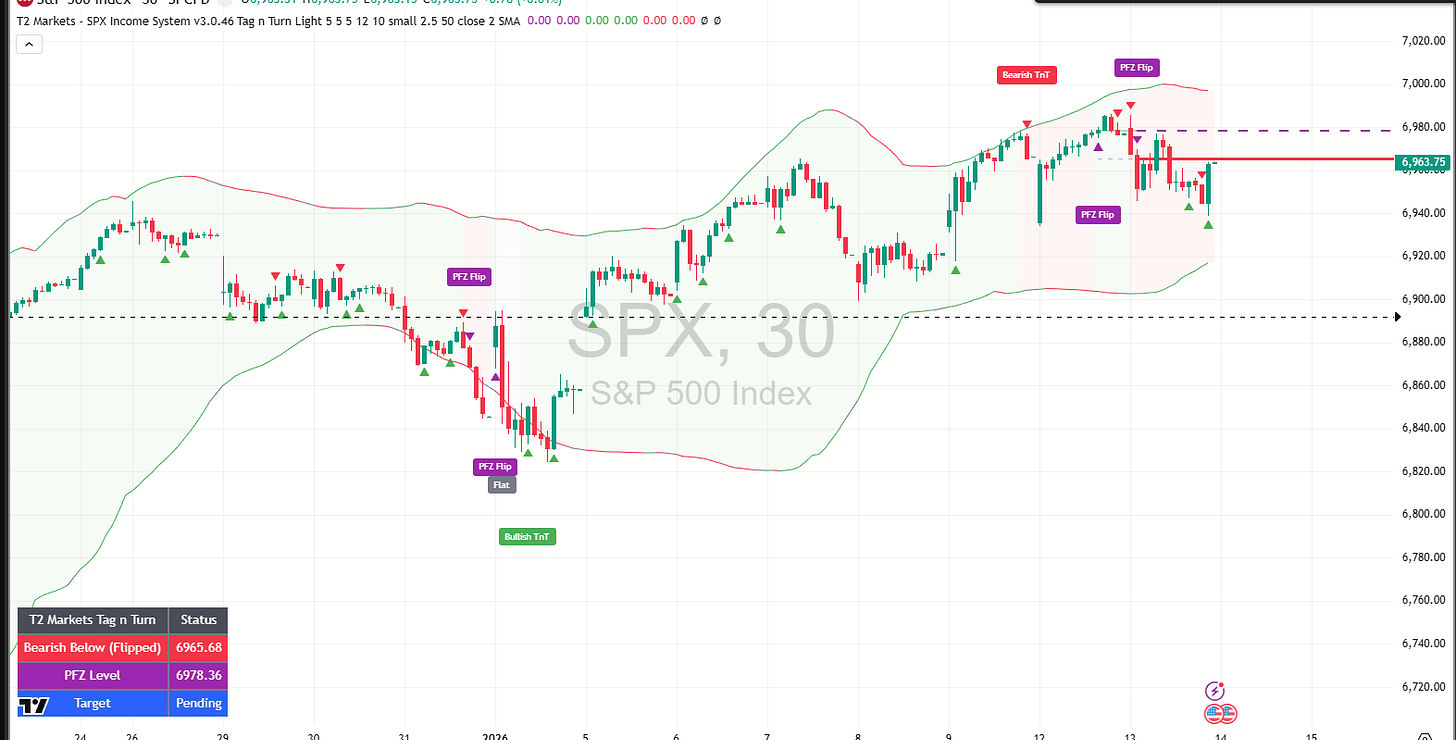

Over on SPX and RUT we can see the details of the flipping and flopping with the Tag n Turn setup. The system is once again bearish having realized a few small losses along the way.

We are now back to waiting to see what unfolds. Given the already-moving overnight moves on futures – the bear is again looking good.

Upper boundary hit. Nasdaq leading down. Systematic patience rewarded.

Range boundaries exist for a reason. Price respects them. So should we

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

Market Briefing:

The market gave the bulls every opportunity-but they hesitated.

SPX and RUT both touched their upper consolidation boundaries.

Then paused.

Then backed off.

The Tag n Turn flipped back to bearish. After a few minor scratches, it’s now ready to ride the next range move.

Meanwhile, NQ continues its own anti-social game.

It didn’t participate in the recent highs.

It’s lagging.

Again.

This isn’t a sudden bear collapse.

It’s a slow, systematic withdrawal of bullish conviction.

Until the bear roars properly, it’s paper cuts and scalp trades.

Nasdaq – Leading the Bear Charge

NQ never even joined the recent bull party. Whilst ES, YM, and RTY were pushing NATHs, Nasdaq lagged. Now it’s leading the move down. Classic rotation – the laggard becomes the leader in the opposite direction.

Current: 25,729.50 | NATHs: 26,399 | Gap: -2.5%

SPX – Bear TnT Active

After all the flipping, the system has settled bearish. Price hit the upper consolidation boundary and rejected.

Price banged against the upper boundary - Classic range behavior – upper boundary → expect move to lower boundary.

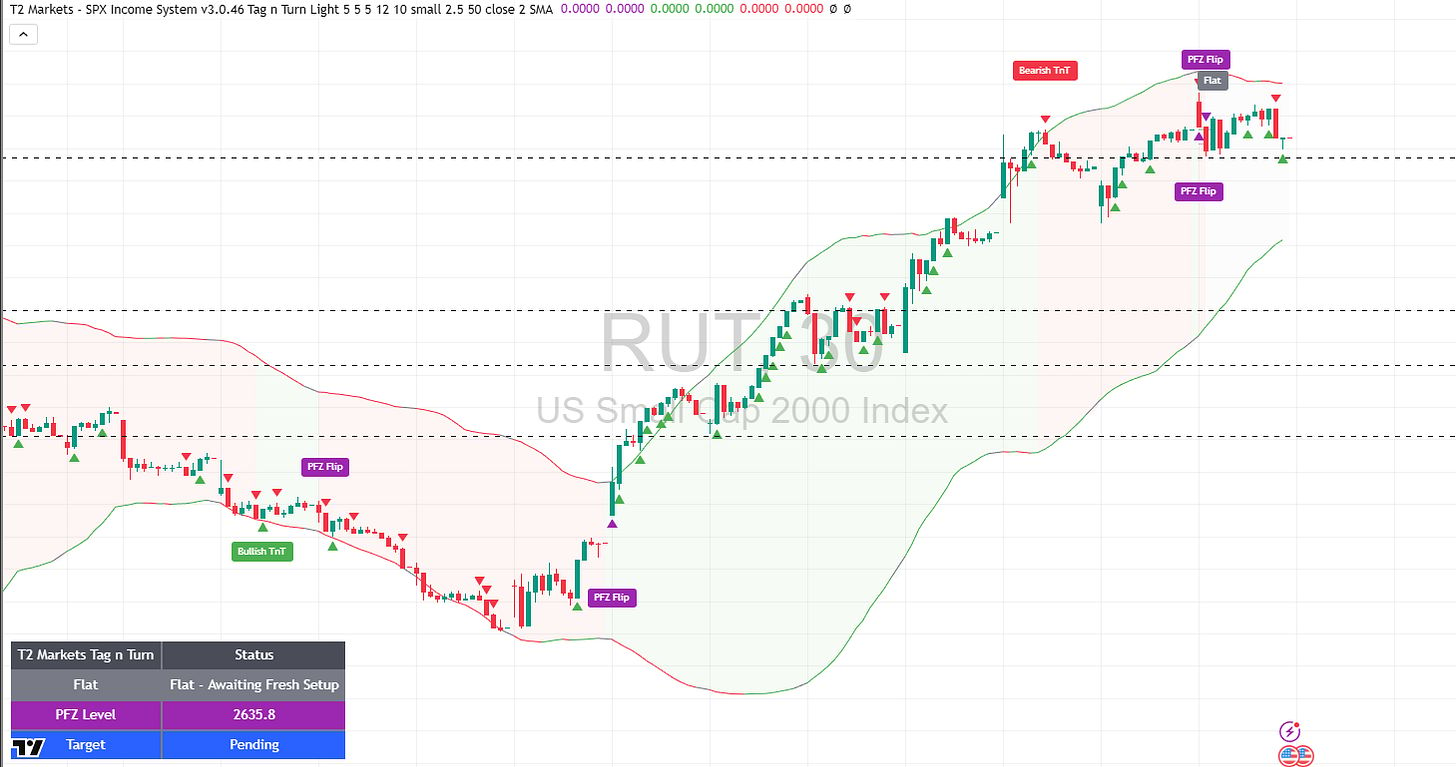

RUT – Flat, Awaiting Fresh Setup

RUT sitting flat whilst the system awaits a fresh setup signal.

RUT – Flat, Awaiting Fresh Setup

RUT sitting flat whilst the system awaits a fresh setup signal.

6 Money Making Patterns: Range Boundaries

This is one of the core systematic patterns:

At upper range → expect move to lower range At lower range → expect move to upper range

Price hit the upper consolidation boundary. The next expected move? Down toward the lower boundary. Not prediction – pattern recognition based on decades of price behavior.

Yesterday’s CPI / JPM Recap

CPI came in as expected (0.3% MoM, 2.7% YoY). Core beat expectations (0.2% vs 0.3% expected).

JPM beat earnings ($5.23 vs $5 expected) but Dimon warned about “potential hazards—including from complex geopolitical conditions, the risk of sticky inflation and elevated asset prices.”

Stock fell despite the beat. Market didn’t like the “elevated asset prices” warning from the biggest bank CEO.

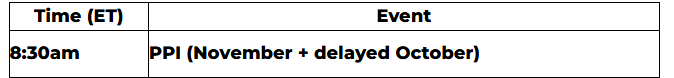

PPI Today

The shutdown messed up the data schedule. Today’s release includes both months. Could move markets if it surprises in either direction.

[Source: BLS]

Expert Insights:

Range-bound markets reward patience and punish impatience.

The flipping and flopping we’ve seen over the past week is classic behavior at range boundaries. Price tests the upper limit. Fails. Tests again. Fails again. Eventually, the path of least resistance becomes clear.

Nasdaq never participating in the recent push higher was the tell. When the weakest index refuses to join a rally, it often signals the rally is running out of steam. Now NQ is leading down – classic rotation.

Dimon’s warning about “elevated asset prices” landed yesterday. The biggest bank CEO telling the market that prices are stretched tends to get attention. JPM beat earnings but the stock fell. That’s the market telling you something.

For systematic traders, none of this requires prediction. Upper boundary hit → expect move to lower boundary. Lagging index leads reversal → confirms direction. VIX jumped from 15 to 17 → volatility waking up.

The bear swing is forming. Patience through the flipping pays off now.

Fun Fact:

The January Barometer: 88.7% Accuracy

Devised by Yale Hirsch in 1972, the January Barometer states “as the S&P 500 goes in January, so goes the year.” The indicator has registered only seven major errors since 1950 for an 88.7% accuracy ratio. Bear markets began or continued when Januarys suffered a loss.

We’re fourteen days into January 2026. Still two weeks to go. And that makes this month’s direction genuinely important for what’s coming.

Yale Hirsch – the founder of the Stock Trader’s Almanac back in 1968 – discovered that January’s direction predicts the full year’s direction with 88.7% accuracy since 1950. Seven errors in 75+ years.

That’s not a pattern.

That’s a law of market behavior.

When January finishes down, bear markets tend to follow.

When January finishes up, the year tends to follow.

Right now we’re sitting at the upper consolidation boundary with a bear swing forming. If this develops into a meaningful January pullback, the Barometer starts flashing warning signals.

If bulls reclaim control and push to new highs, the Barometer stays green.

Either way, what happens in the next two weeks matters more than most traders realize.

The January Barometer doesn’t tell you what WILL happen – it tells you what historically HAS happened 88.7% of the time.

And for systematic traders, that’s edge enough.

[Source: Stock Trader’s Almanac, Jeffrey Hirsch, originally devised by Yale Hirsch 1972]

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply