- Option Income Project

- Posts

- Feck, Trump U-Turns Again – Markets Surge on “Just Kidding” Tariff Reversal | SPX Market Briefing | 22 Jan 2026

Feck, Trump U-Turns Again – Markets Surge on “Just Kidding” Tariff Reversal | SPX Market Briefing | 22 Jan 2026

From Tuesday’s Crash to Wednesday’s Surge – Emotional Rollercoaster Complete

Trump U-turns again.

At this stage, I’m convinced he’s just playing patty-cake with the world economy to… well, I’m not gonna say that.

But we’re all thinking it.

Yesterday was an emotional rollercoaster – playing out exactly as you might expect from a breakdown – and then his “Just kidding!” announcement flipped the market narrative on a dime. Again.

Tuesday: Worst selloff since October. “Sell America!” headlines everywhere.

Wednesday: Best day since November. S&P turns positive for 2026. Bears left holding the bag.

We might not need a crack Nixon interviewer to get at the truth here.

He’s saying it loud and proud, and everyone’s nodding along like this is normal.

Mr Trump-iagi Says “Tariffs on! Tariffs off!”

Greenland deal! No deal! Deal framework!

Markets whipsaw. Rinse. Repeat.

I’ll step off this soapbox now – I don’t have a horse in this race being a non-US resident. But it sure is fun to watch, despite being a headache to trade from time to time.

Keep scrolling – the charts are calmer than the politics…

When Politicians Flip, Systems Stay Steady.

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

Market Briefing:

The “Just Kidding” Rally

Let’s recap the whiplash:

Tuesday: Trump announces 10% tariffs on 8 NATO allies. Greenland ultimatum. Markets crater. “Sell America” trend materializes. Dow drops 875 points. VIX spikes. Bears celebrate.

Wednesday: Trump calls off Europe tariffs. Announces Greenland deal framework with NATO. Markets surge 1.2%. S&P turns positive for 2026. Energy, materials, tech lead gains. Bears… confused.

Bessent told Davos – (not to be confused with Davros – I swear I thought the Daleks were invading!) – the administration was “not concerned” about market volatility.

I bet they’re not.

Current Multi-Market Status:

SPX: TnT Flat – Awaiting Fresh Setup – PFZ 6833.79 – Target Pending

RUT: TnT Bearish Below – Status 2689.23 – PFZ 2703.75 – Target 2644.4 (flipping bullish after open)

ES: 6,951.00 – Recovering strongly towards NATHs

YM: 49,456 – Back in business

NQ: 25,688.00 – Tech leading the bounce

RTY: 2,719-2,727 – At NATHs, breakout confirmed

GC: 4,891.1 – Still at NATHs (flight to safety bid remains)

CL: 59.93 – Bouncing

VIX: 16.07 – Collapsed back to complacency

BTC: 89,963.31 – Steadying after Tuesday’s plunge

RUT: The Firm Breakout

Uncle Russell has made his move.

While the other indexes were teasing bear breakouts that never quite committed, RUT has delivered a firm breakout to the upside. The range that contained price for weeks has been decisively cleared.

Breakout target: 2784 level.

The initial bear TnT that developed during the selloff will be flipped to bullish using the PFZ level – probably just after the opening bell. The larger pattern is now pointing up.

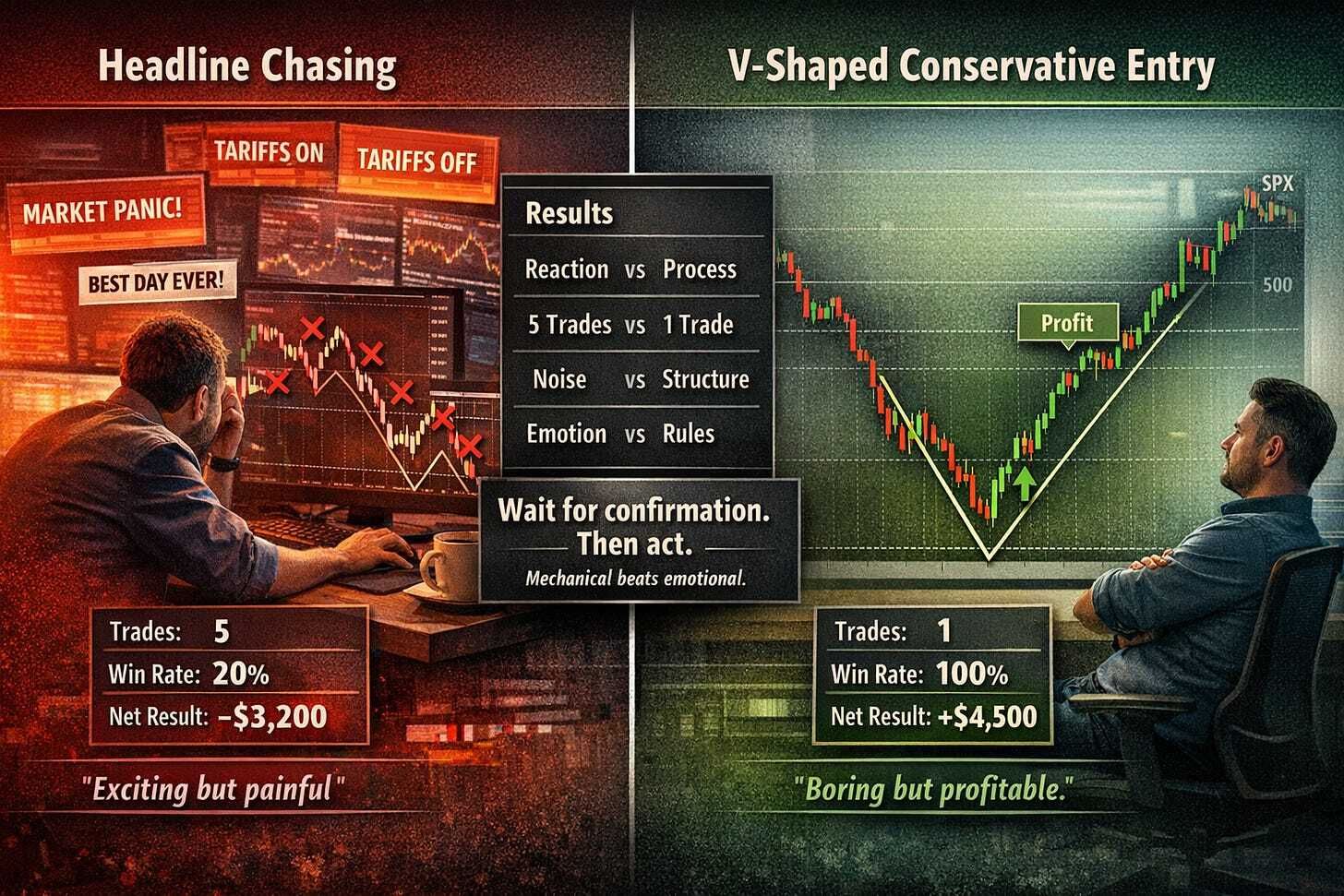

SPX: V-Shaped Conservative Entry

As we discussed yesterday, SPX is setting up for a V-shaped conservative entry pattern. The TnT is flat and awaiting fresh setup, which means we’re in decision territory.

The teased bear breakout has reversed back into range. Range reversals are now the theme across indexes – those who chased the breakdown are being squeezed.

This is why we wait for mechanical confirmation rather than chasing headlines.

Supreme Court Wildcard

Worth watching: All nine justices questioned Trump’s bid to fire Fed Governor Lisa Cook yesterday. Kavanaugh warned it “would weaken if not shatter” Fed independence.

Powell and Cook attended the arguments. The ruling could protect central bank independence for years – or open Pandora’s box.

For now, markets are ignoring this in favor of the tariff relief rally. But it’s a story that could matter later.

PCE Data Today

The 43-day shutdown created a data vacuum. Today we get delayed PCE inflation data covering October and November.

Economists expect 2.7-2.8% core PCE. Anything above 2.8% could force the Fed to stay restrictive longer.

One more potential volatility catalyst in a week that’s already had plenty.

Expert Insights:

Trading the Untradeable

When political announcements can reverse market direction in minutes, the only defense is mechanical discipline.

Tuesday’s breakdown looked textbook. Wednesday’s reversal made it a trap. Traders who chased either direction based on headlines are nursing losses. Traders who waited for confirmation patterns are still positioned correctly.

The V-shaped conservative entry exists precisely for moments like this. Rather than guessing which political tweet will stick, we wait for price to confirm direction and then join the move already in progress.

Boring? Perhaps. Profitable? Consistently.

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply