- Option Income Project

- Posts

- Dow NATH, Russell Rips, SPX Yawns – Inside Day Setup? | SPX Market Briefing | 6 Jan 2026

Dow NATH, Russell Rips, SPX Yawns – Inside Day Setup? | SPX Market Briefing | 6 Jan 2026

Upper Wicks Everywhere – Inside Day Incoming?

Yesterday was a tale of two markets.

The Dow and Russell put in huge trending days. Uncle Russell absolutely ripped higher. Meanwhile, the S&P and Nasdaq looked at all that momentum and said “nah, we’re good” and spent the day going nowhere.

Then all of them kicked back into the close, leaving large wicks at the upper end of their daily ranges.

You know what that typically means? Narrow range day incoming. Possibly an inside day.

Which sets the tone nicely – today might be a whole lot of nothing. And that’s fine. Sometimes the best trade is no trade.

Let’s break it down.

Patience isn’t just a virtue. Sometimes it’s the entire strategy.

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

Market Briefing:

Multi-Market Snapshot

It was an interesting day yesterday on the indexes.

The Divergence

Dow and Russell put in huge trending days. I mean really trending – the kind of clean, directional moves you want to see.

Meanwhile, SPX and Nasdaq stuttered and never really got going at all. They gapped higher at the open and then just… sat there. Meandering. Chopping. Going nowhere with purpose.

The Upper Wicks

Here’s the interesting bit: all of the indexes kicked back into the close, creating larger than normal wicks at the upper end of their daily ranges.

Typically when I see this, I anticipate a narrow ranging day – possibly an inside day. Which may set the tone for today.

The Bigger Picture

Despite Dow making new all-time highs, prices are still contained. Nothing new is really developing. The consolidations that have been present since October last year are still in effect.

As usual, until something new happens, the same thing is likely to continue.

Range bound. Chop. Patience required.

SPX Analysis

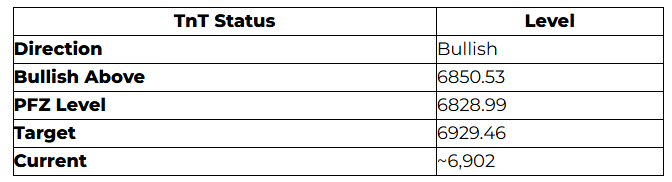

The Tag n Turn that developed last Friday continues to work.

Currently bullish above 6850.53, targeting 6929.46. PFZ level sits at 6828.99.

But here’s the thing – price is just meandering sideways after the gap higher at the open. As just mentioned, I’d expect prices to continue to meander.

And with price not near the upper or lower Bollinger Bands, there’s likely nothing to do in the short term from a swing perspective.

The setup is working. It’s just not exciting. And that’s fine.

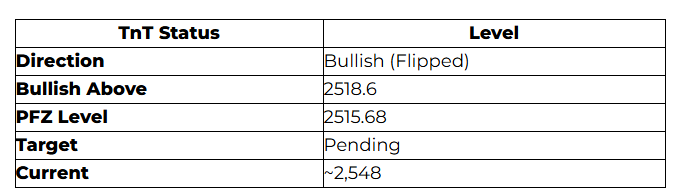

RUT Analysis

Uncle Russell made a power move higher yesterday.

The Tag n Turn flipped bullish above 2518.6, with PFZ at 2515.68. Target pending.

Now here’s my confession: I’ve not been able to get on board with this Tag n Turn. And this is one of those times where not being in a rush to do anything kicks me in the shins.

The move happened. I wasn’t in it. Such is life.

That said, the Premium Popper continues to scalp the open beautifully.

Yesterday’s Poppers:

Trade 1: 61.5% ROC

Trade 2: 53.3% ROC

Combined: 114.8% ROC

Setup Grade: A+ (both)

Two A+ setups right at the open. Mechanical execution. Premium collected.

The system doesn’t care that I missed the swing. The system just keeps paying.

What I’m Watching Today

Inside Day Potential – Those upper wicks suggest today could be narrow and contained. If we get an inside day, it sets up potential for a larger move tomorrow.

Premium Popper Setups – As always, watching the open for A+ setups. The system keeps delivering.

The Do Nothing Zone – SPX is mid-range on the Bollingers with no clear edge. Sometimes the best trade is patience.

Looking Ahead

The Dow made new highs. Russell trending hard. SPX and Nasdaq can’t be bothered.

Upper wicks suggest today might be narrow and quiet. An inside day setup is in play.

The October consolidation refuses to die. And that’s fine. Until it breaks, we trade the range.

SPX TnT working but meandering. RUT TnT left without me. Premium Popper keeps scalping regardless.

Sometimes patience is the strategy. Sometimes patience kicks you in the shins. The system doesn’t care either way.

PopPop.

Expert Insights:

The Upper Wick Tell

Here’s a pattern worth noting: when you see large upper wicks across multiple indexes after a trending day, it often signals exhaustion at those levels.

Buyers pushed price higher, but sellers showed up into the close and pushed it back down. The resulting wick tells you there’s supply overhead.

What typically follows? One of two things:

Inside day / consolidation – Market digests the move, coils up, then breaks

Continuation lower – The rejection was the start of a pullback

Given we’re still in the October consolidation range and nothing has really broken out, option 1 feels more likely. Expect chop, expect narrow range, expect boredom.

Which is fine. Boredom pays well when you’re selling premium.

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply