- Option Income Project

- Posts

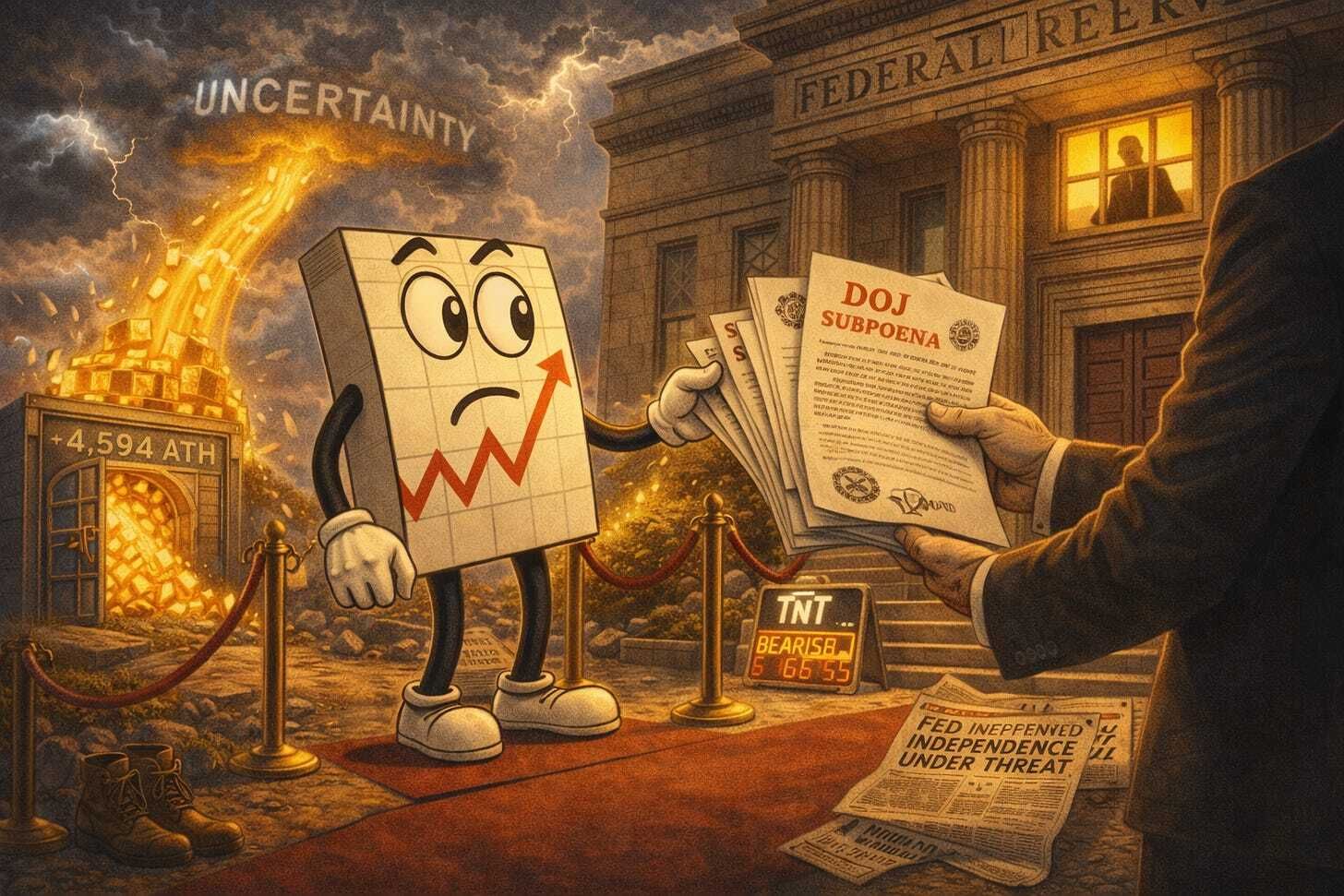

- DOJ Subpoenas Powell. Fed Independence Under Attack. Strap In. | SPX Market Briefing | 12 Jan 2026

DOJ Subpoenas Powell. Fed Independence Under Attack. Strap In. | SPX Market Briefing | 12 Jan 2026

We Just Entered January’s Weakest Stretch – Trading Days 7-13

With the first full week of the new year under our belt, a Venezuelan bid for freedom, and now eyes once again pointing to Greenland… NFP was such a flop that people questioned if it were even released. What about those pesky Epstein files?

And then Sunday night happened.

The Justice Department served the Federal Reserve with grand jury subpoenas on Friday. Criminal indictment threatened against Fed Chair Powell. The pretext? His June testimony about a $2.5 billion headquarters renovation.

Powell released a video statement Sunday evening. His words: “This unprecedented action should be seen in the broader context of the administration’s threats and ongoing pressure.”

He added: “The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

Fed independence is under attack. Gold’s hitting new all-time highs. VIX jumped. Markets are reacting.

Whatever happens – gonna be interesting.

[Source: Federal Reserve Statement, Bloomberg, NBC News]

Gold screams. Bears wake. Seasonal weakness arrives on schedule. Scroll down.

When the world goes mad, systematic traders still execute.

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

Market Briefing:

Monday brings the kind of news that makes you wonder if you’re watching a late night comedy sketch. Except it’s real. And markets are reacting.

Current Multi-Market Status:

ES: 6,962.25 – selling off NATHs (7,014)

YM: 49,379 – selling off NATHs (49,876)

NQ: 25,718.75 – weakest, lagging

RTY: 2,628.5 – selling off NATHs (2,650)

GC: 4,594.8 – NEW ATH, flight to safety

CL: 58.57 – bouncing around

VIX: 16.33 – jumped sharply overnight

SPX – Bear TnT Triggered

SPX tipped over literally at the final bell on Friday. New Bear Tag n Turn active.

Assuming this range holds, we can presume that the previous expanding triangle pattern has evolved and mutated a little. That gives a target down towards 6800.

RUT – Already Turned Lower

Uncle Russell has already turned lower on a Tag n Turn. Similar patterns can be seen.

A larger target could be down to 2500 for the same reasons mentioned for SPX.

It’s been a while where the moves have been in lockstep. Let’s see how long this continues.

Gold – Flight to Safety

Gold has leapt to new all-time highs at 4,594.8. When the DOJ subpoenas the Fed Chair and threatens criminal indictment, yes – gold moves. VIX has also jumped sharply compared to the overnight futures moves. 16.33 and climbing.

The safe havens are waking up.

The Week Ahead

As usual, just waiting for the open to take action and see what Poppers develop for a little scalping love at the open.

Expert Insights:

The Federal Reserve is designed to be independent from political pressure so policymakers can make sometimes unpopular decisions – like raising interest rates to keep inflation in check.

Powell’s term as chairman expires in May. Trump has been outspoken about wanting lower rates. The administration has also tried to remove another Fed board member, Lisa Cook.

Senator Thom Tillis (R-NC) responded: “If there were any remaining doubt whether advisers within the Trump Administration are actively pushing to end the independence of the Federal Reserve, there should now be none.”

Markets don’t like uncertainty about monetary policy independence. Hence gold’s move. Hence the VIX jump.

[Source: Federal Reserve Statement, NPR, NBC News]

Fun Fact: January’s Weakest Stretch: Trading Days 7-13

We just entered it. Jeffrey Hirsch from Stock Trader’s Almanac flagged the pattern last week – January opens strong then fades, with the weakest stretch historically running from around the seventh trading day through the twelfth or thirteenth.

Here’s the thing about seasonal patterns – they don’t care about your feelings OR about DOJ subpoenas!

Jeffrey Hirsch, the man who literally wrote the book on market seasonality (Stock Trader’s Almanac, look it up), dropped this chart showing 21 years of January data.

The pattern? January starts strong with all major indexes – DJIA, S&P 500, NASDAQ, Russell 1000 and 2000 – logging gains through around mid-month. Then weakness creeps in with sideways and choppy trading through month end. The weakest stretch? Trading days 7 through 13. Today is trading day 7.

We’re literally entering the danger zone right as the DOJ decides to subpoena the Fed Chair. Coincidence? Probably. But seasonal patterns plus political chaos plus Bear TnT triggers equals the kind of confluence that makes systematic traders pay attention.

The chart shows solid lines for recent 21-year performance (2005-2025) and dotted lines for midterm years (1950-2022) – and both show the same mid-month weakness pattern. Sometimes the market just does what it does, regardless of headlines. And right now, what it does is weaken mid-January. Bears armed with seasonal data AND TnT triggers AND flight to safety in gold?

That’s not prediction – that’s pattern recognition meeting systematic execution!

[Source: Stock Trader’s Almanac – Jeffrey Hirsch, Hirsch Holdings Inc.]

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply