- Option Income Project

- Posts

- Bollinger Bands Start Squeezing - Volatility Likely to Dip

Bollinger Bands Start Squeezing - Volatility Likely to Dip

Hi Traders!

What a week.

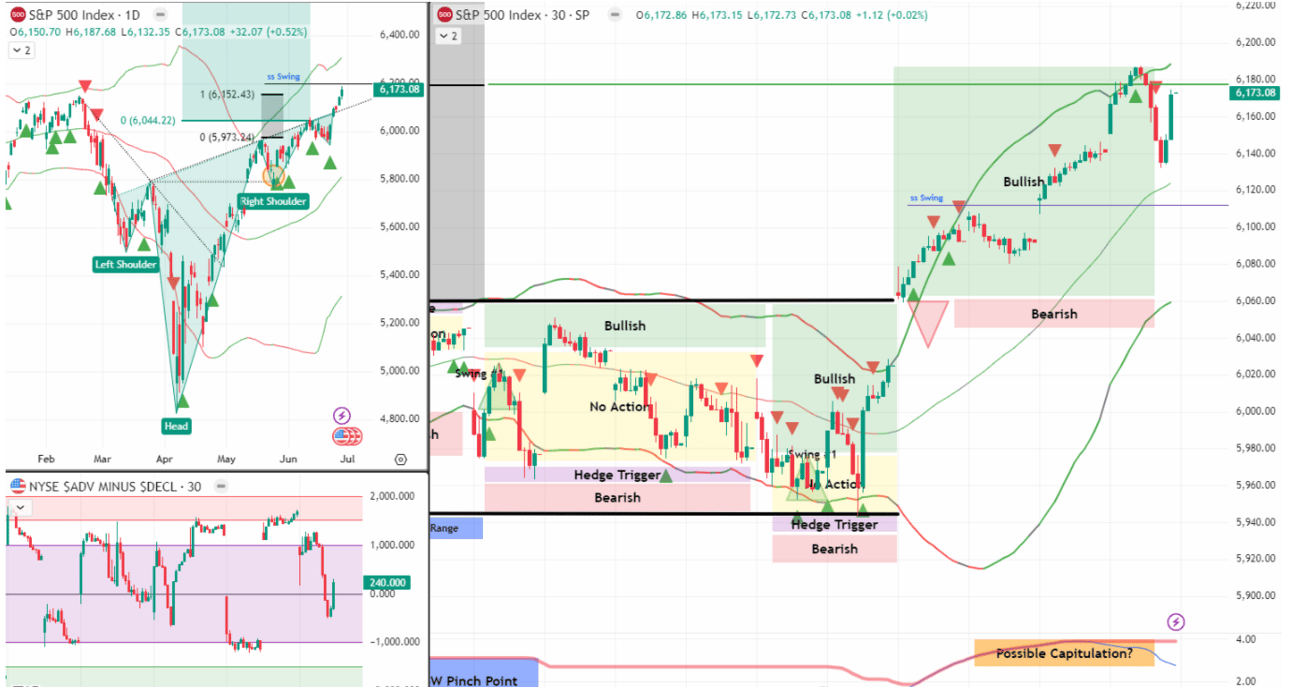

We saw the breakout of that well defined range we flagged back on 12/13 June. After price reversed off the range low my students and I bagged a string of stellar trades. Now a new week greets us - end of month, start of month, NFP on Friday and a fresh Bollinger squeeze on the tape. Time to map the likely pause and plan the next strike.

▶️ Grab coffee, scroll down, and lock in your game plan

SPX Market Briefing

Friday’s session kicked off the first noticeable Bollinger Band contraction in two weeks. A squeeze by itself is no trigger, but coupled with the calendar it screams “cool-down.”

We also reached the measured breakout target. That target tap came with an upper Tag n Turn - a classic “cash the ticket, take a breath” marker. I do not expect a face-melting selloff, yet I’m even less inclined to chase fresh highs.

Strategy for the next 48-72 hours is simple: credit spreads out the money, 2-DTE to 3-DTE, letting theta bleed while SPX drifts, and wait for Friday’s jobs print.

Key levels

• 6180/6200 – breakout target and Friday high – resistance until decisively cleared

• 6160 – Friday midpoint – intraday pivot

• 6100/6120 – Possible range lows (assuming BB contraction develops)

• >6200 – New Breakout – line where bullish bias returns

Happy Trading!

T2 Markets

Let’s zoom in on the setup that paid… and how to catch the next one.

SPX Options = Cashflow Engine.

With this setup? It’s practically an ATM with a checklist.

SPX Market Briefing

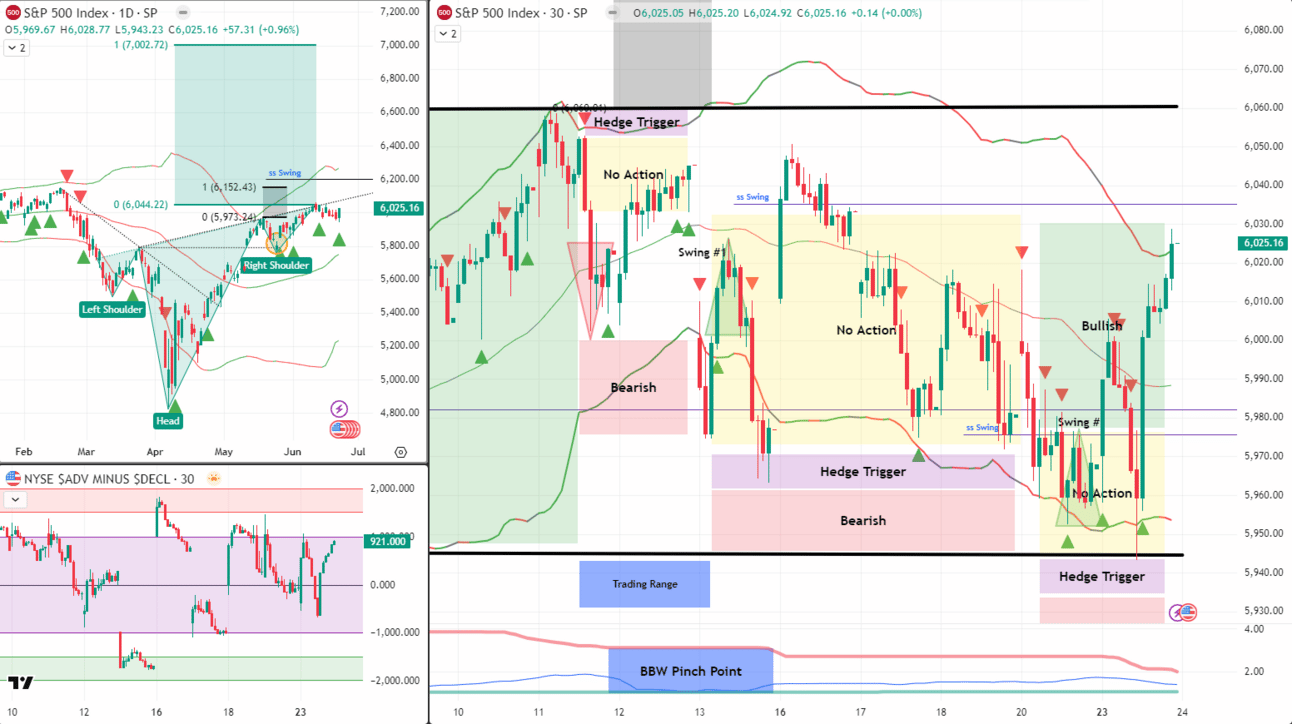

Today’s game plan builds on yesterday’s price behavior.

The new trade is in the green. That flips my mode into “Add-In Ready” – meaning new Pulse Bars can be stacked into strength if the setup justifies it.

But I’m not chasing. The range still matters.

My operating structure is:

Range high = 6060

Range low = 5940

Stay inside, play the levels. Break out? New game.

What changes things?

News flow.

A 12-day ceasefire in the Middle East just hit the wires. While geopolitical spikes haven’t broken the range yet, reduced tension could be just the psychological lift bulls need to push past 6060.

If that happens – I’ll be watching for a retest setup with size.

Until then, it’s system rules, pulse setups, and layered discipline.

Happy trading,

T2 Markets

Want to fast track your success? Book a call with our team!

Reply