- Option Income Project

- Posts

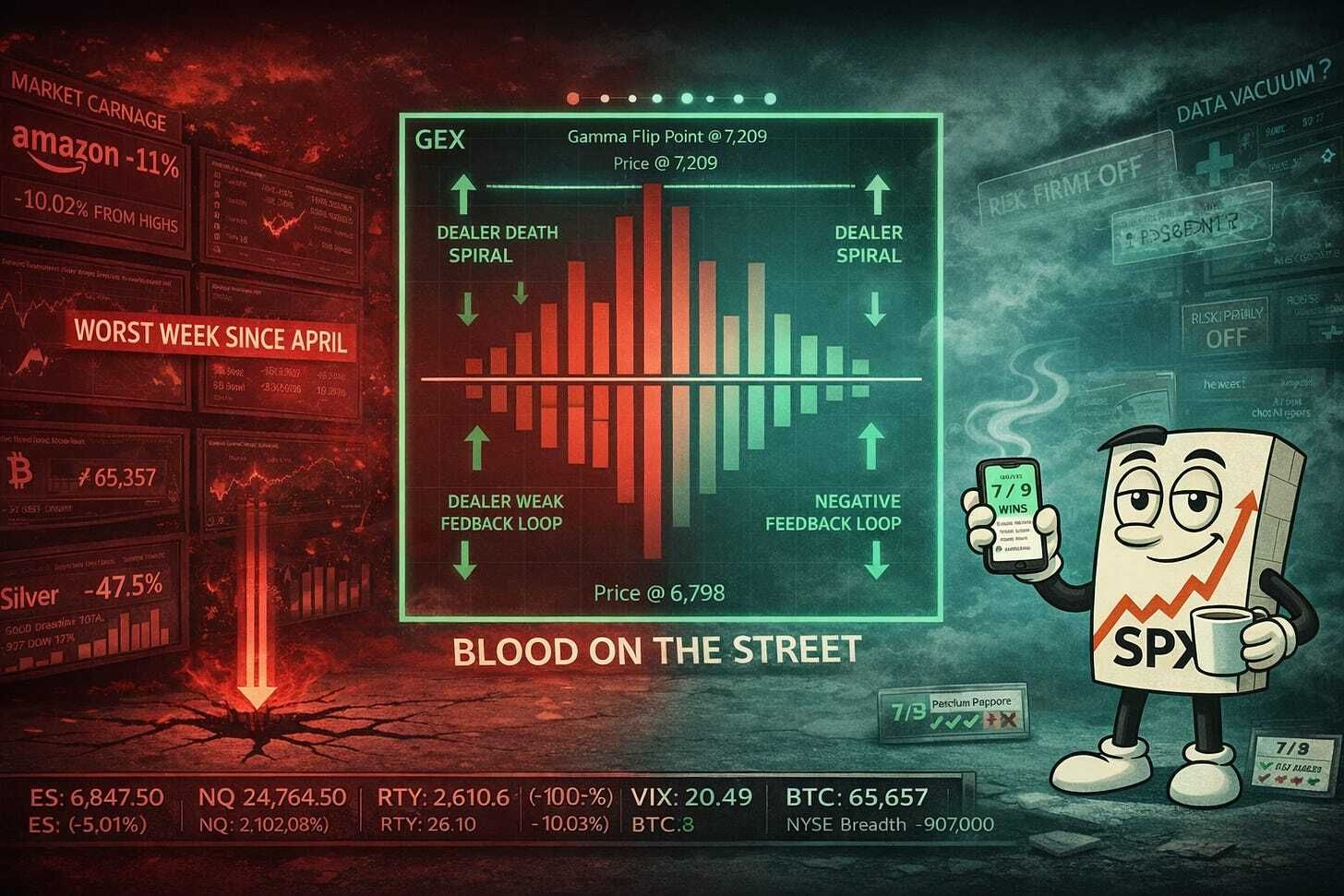

- Blood On The Street. Amazon’s $200B Capex Bomb Sinks Nasdaq Like The Titanic. | SPX Market Briefing | 6 Feb 2026

Blood On The Street. Amazon’s $200B Capex Bomb Sinks Nasdaq Like The Titanic. | SPX Market Briefing | 6 Feb 2026

Carnage Premium Poppers Pop 7 For 9 – Net Winning Day While Markets Burn Around Us

Well. What a day. What a bloody week.

The bear thesis continues to deliver and there is most definitely blood on the street as the carnage rolls on.

The laggards are the Dow and Russell with big tech taking some seriously heavy declines pulling the Nasdaq down like a sinking Titanic.

The SPX bear swings continue and the conservative override was absolutely the right thing to do this week – the mechanical systems flipped back to bearish and we’ve avoided having to flip and flop. That’s the entire point.

RUT is bearish and dragging its feet. I’ll be looking for the V-Shaped Entry at the range lows and delaying a bullish trade.

Premium Poppers popping again – 9 trades, 2 losses, net winning day. Detailed round up at the end of the week.

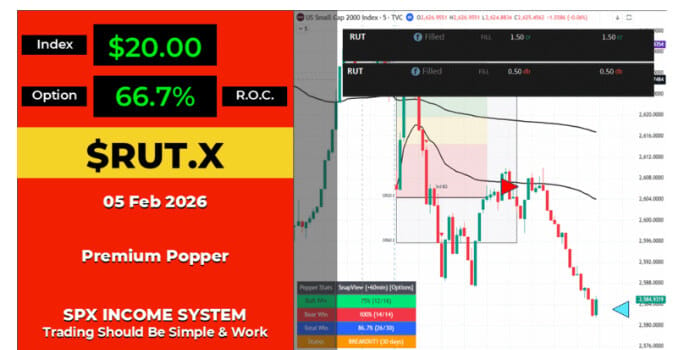

And here’s something different today – I’m looking at the GEX (Gamma Exposure) and it’s all negative. Every single strike. Which could well accelerate the moves down today.

Overnight futures already blasted lower and as I typed had reversed again. Classic.

Crypto is taking an absolute hammering and that has not yet translated to the main indexes but these markets look exceptionally heavy. Risk is firmly taken off.

Keep scrolling for the GEX breakdown and why this gamma setup matters…

Blood On The Street. $200B Capex Bomb. Negative Gamma Everywhere. Poppers Still Popping.

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

Market Briefing:

Friday 6 Feb reviews bear thesis continuing to deliver (blood on street, carnage continues, laggards Dow and Russell, big tech pulling Nasdaq down like sinking Titanic),

SPX bear swings continuing (conservative override right call this week, mechanical systems flipped back bearish, avoided flip-flop),

RUT bearish despite dragging feet (looking for V-Shaped Entry at range lows, delaying bullish trade),

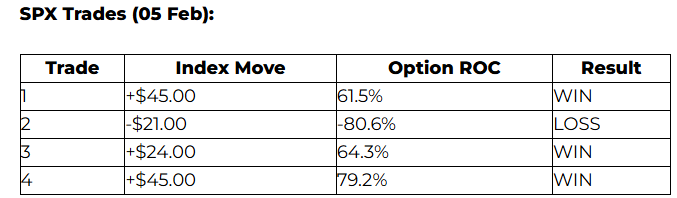

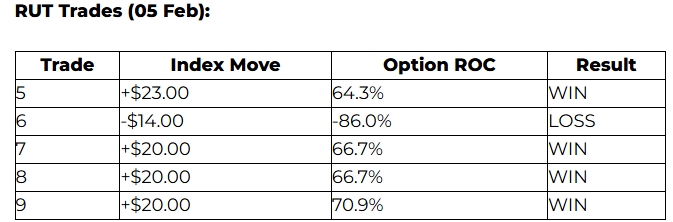

Premium Poppers popping again (9 trades, 2 losses, net winning day via mobile, detailed round up end of week),

GEX showing only negative gamma exposure (could accelerate moves down, overnight futures blasted lower then reversed),

crypto taking huge hit not yet translated to main indexes (markets exceptionally heavy, risk firmly off),

Amazon -11% on $200B capex bomb ($146.6B expected), Dow -593, SPX -1.23% to 6,798, Nasdaq -1.59%, worst week since April,

Bitcoin collapsed through $61K, silver -47.5%, gold -17%,

NFP delayed to Wednesday, CPI to Friday, Eli Lilly GLP-1 bright spot, Big Tech AI capex totals $520B for 2026.

Current Multi-Market Status:

ES: 6,847.50 (NATHs 7,043) – down 352.75 pts (-5.01%)

YM: 49,115 (NATHs 49,901) – down 2,504 pts (-5.02%)

NQ: 24,764.50 (NATHs 26,399) – down 2,639.50 pts (-10.02%)

RTY: 2,610.6 (NATHs 2,749.2) – down 275.8 pts (-10.03%)

GC: 4,884.4 (NATHs 5,626.8) – down 21.39% from highs

CL: 55.12 – sliding on US-Iran nuclear talks

VIX: 20.49 – elevated but not panicking

BTC/USD: 93,161 -> 65,657 – post-election gains evaporated

NYSE Advance-Decline: -907,000 (firmly negative breadth)

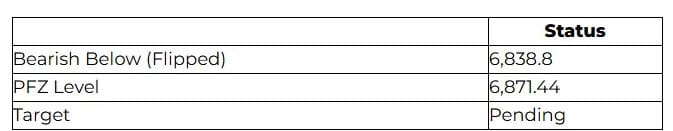

SPX Tag ‘n Turn – Bear Swings Continue

Tag ‘n Turn Status:

SPX is sitting right at the target range lows with the daily showing price at 6,814. The bear swing continues and the conservative override this week was exactly the right call.

The mechanical systems flipped back to bearish which means we’ve avoided the dreaded flip-flop that catches so many traders out. When the market is this choppy, patience and the override keep you on the right side.

SPX closed at 6,798 on Thursday – now negative for 2026. The range we’ve been tracking since October continues to define the battlefield.

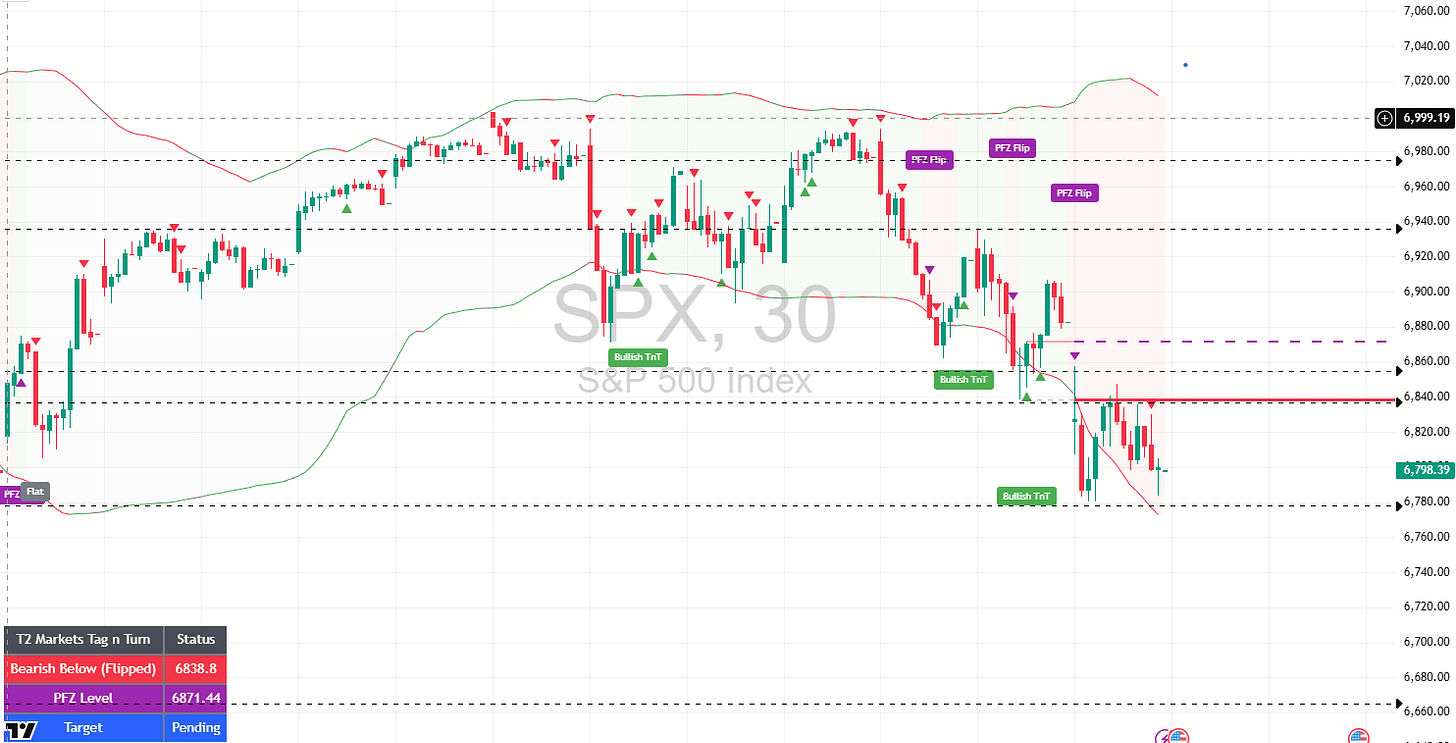

StatusBearish Below (Flipped)6,838.8PFZ Level6,871.44TargetPending

SPX is sitting right at the target range lows with the daily showing price at 6,814. The bear swing continues and the conservative override this week was exactly the right call.

The mechanical systems flipped back to bearish which means we’ve avoided the dreaded flip-flop that catches so many traders out. When the market is this choppy, patience and the override keep you on the right side.

SPX closed at 6,798 on Thursday – now negative for 2026. The range we’ve been tracking since October continues to define the battlefield.

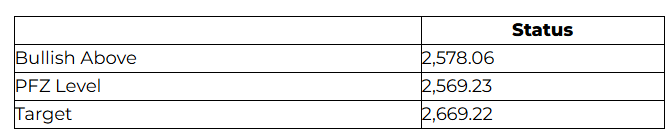

RUT Tag ‘n Turn – Bearish But Dragging Its Feet

Tag ‘n Turn Status:

RUT is bearish and remains that way despite dragging its feet on the bear moves. The head and shoulders pattern visible on the 30-minute chart continues to play out.

I will be looking for the V-Shaped Entry at the range lows here and delaying any bullish trade until we see something worth committing to. No rush. The range lows are clearly marked and a bounce from there would give us a far better entry than trying to catch a falling knife mid-air.

RTY futures down 275.8 points (-10.03%) from NATHs. That’s a proper correction by anyone’s measure.

Another day, another batch of Popper setups firing across both SPX and RUT.

Day Summary: 7 wins, 2 losses (77.8%) – net profitable day.

Follow the process and let the setups do their thing.

Two gongs in there but the 7 winners more than cover them. A more detailed round up of the week’s trades coming at the end of the week.

GEX – Negative Gamma Across Every Strike

Something different today. I’m looking at the GEX (Gamma Exposure) chart and it’s telling quite a story.

Every single strike is showing negative gamma exposure. Not a mixed bag. Not mostly negative. Every. Single. One.

The SPX gamma flip point sits up at 7,209.10 and price is down at 6,798. That’s a massive gap. Put wall and call wall both at 7,000.

What does this mean in plain English? When dealers are this short gamma, they’re forced to hedge by selling into selloffs and buying into rallies. It creates a negative feedback loop that amplifies moves in both directions.

This is why overnight futures blasted lower and then reversed. Classic negative gamma behavior – outsized swings as dealer hedging flows pile onto whatever direction the market moves.

It could well accelerate the moves down today. Or produce a face-ripping bounce that catches everyone off guard. Negative gamma doesn’t choose a direction – it just makes whatever happens, happen bigger.

Amazon’s $200B Capex Bomb

The headline that dominated after hours: Amazon crashed 11% on a $200 billion capex guidance that dwarfed the $146.6B the Street was expecting.

$1.95 EPS missed $1.97 despite a $213.4B revenue beat. AWS grew 24%. But none of that mattered when the capex number hit.

Here’s the context: Alphabet got a pass on Wednesday for $175-185B capex. Amazon didn’t. The market is getting pickier about who gets to spend $200B on AI infrastructure.

Big Tech AI capex now totals $520B for 2026. Reddit beat with $1.24 EPS and announced a $1B buyback. Snap beat Q4 and was up 7% premarket. Peloton crashed 28%. Uber missed by 5.2%.

The “beat and die” pattern continues. Meet every metric and the market shrugs. Miss one and it’s a firing squad.

Data Vacuum

The BLS delayed today’s NFP report to Wednesday (11 Feb) after last week’s government shutdown. CPI pushed to 14 Feb.

Markets are flying blind during the worst selloff in months. No labour data. No inflation data. Just Amazon’s capex bill and a sea of red.

The 10-year yield fell toward 3.9% as flight to safety accelerates. Dollar strength pressuring commodities. Credit stress building but not yet systemic.

AI-BotView

Three observations from the machine:

1. The GEX chart is screaming. Every strike negative. In October 2023, SPY reached extreme negative gamma (approaching -3 billion) after a 10% selloff from late July highs – and that marked the exact low before a 15% rally over the following weeks. Not saying we’re at the same inflection point, but extreme negative gamma readings have historically preceded significant reversals. Worth watching closely. [Source: Geeks of Finance – “How Gamma Exposure Works” – medium.com/@thegeeksoffinance]

2. The “hiding in healthcare” rotation is textbook. Eli Lilly surging 8% whilst Nasdaq bleeds out is exactly what happens when institutions reduce risk but can’t go fully cash. They rotate into defensive sectors with visible earnings growth. McKesson +16.5%, Amgen +8.2%. When the big money picks a hiding spot, it tells you what they think about near-term risk appetite for growth.

3. Crypto and precious metals crashing simultaneously is unusual. Normally one acts as a hedge for the other. Bitcoin down to levels that erase every post-election gain. Gold down 17% from highs. Silver’s 47.5% crash is the worst since 1980. When everything correlated trades in the same direction, it usually signals forced liquidation rather than fundamental repricing. Margin calls don’t discriminate between asset classes.

Expert Insights:

Negative gamma creates what traders call the “dealer death spiral” – when price drops, dealers sell to hedge, which pushes price lower, which forces more selling. The same mechanism works in reverse on bounces. This is why negative gamma environments produce those whipsaw sessions where futures crash overnight then rip back by the open.

For premium sellers, this is actually interesting territory. Elevated VIX means fatter premiums. The key is respecting the mechanical rules – conservative entries, proper position sizing, and letting theta do the heavy lifting whilst the market thrashes around. The system doesn’t care about Amazon’s capex bill. It cares about the process.

Fun Fact:

In October 2023, SPY reached extreme negative gamma readings approaching -3 billion in net negative GEX after selling off approximately 10% since late July. That date (27 Oct) proved to be a major low in the market, with SPY subsequently rallying nearly 15% over the coming weeks. Extreme negative gamma doesn’t just amplify moves down – historically, the snap-back can be equally violent.

[Source: Geeks of Finance – “How Gamma Exposure Works: Unravelling the Dynamics of Risk Hedging” ]

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply