- Option Income Project

- Posts

- $7 Move. 2 Trades. 148% Combined ROC. Premium Selling Shines Again. | Post Trade DeBrief 30 Dec 2025

$7 Move. 2 Trades. 148% Combined ROC. Premium Selling Shines Again. | Post Trade DeBrief 30 Dec 2025

Santa Rally Still MIA. Price Stuck Under VWAP. Bears Still In Control.

December 30th delivered 2 Premium Popper trade setups on RUT.

Now interestingly, I was fully expecting to see price turn bullish for the much anticipated Santa Rally.

However, price remained firmly under the 2-day VWAP.

And using that as my directional bias, my first trade uses the current day’s VWAP to “sell the rally.”

Other factors here not on the chart were that price pushed through the prior day’s lows – a classic pullback entry setup. Not quite an A+ setup as it’s not too clean looking. Perhaps a B+.

At its most basic? This is a VWAP setup.

My second entry is a classic ORB20 breakout setup. The stats on the screen show this has high confidence and a 95.3% win rate in the last 30 days.

Keep scrolling for why a $7 move made premium sellers rich whilst futures traders twiddled their thumbs…

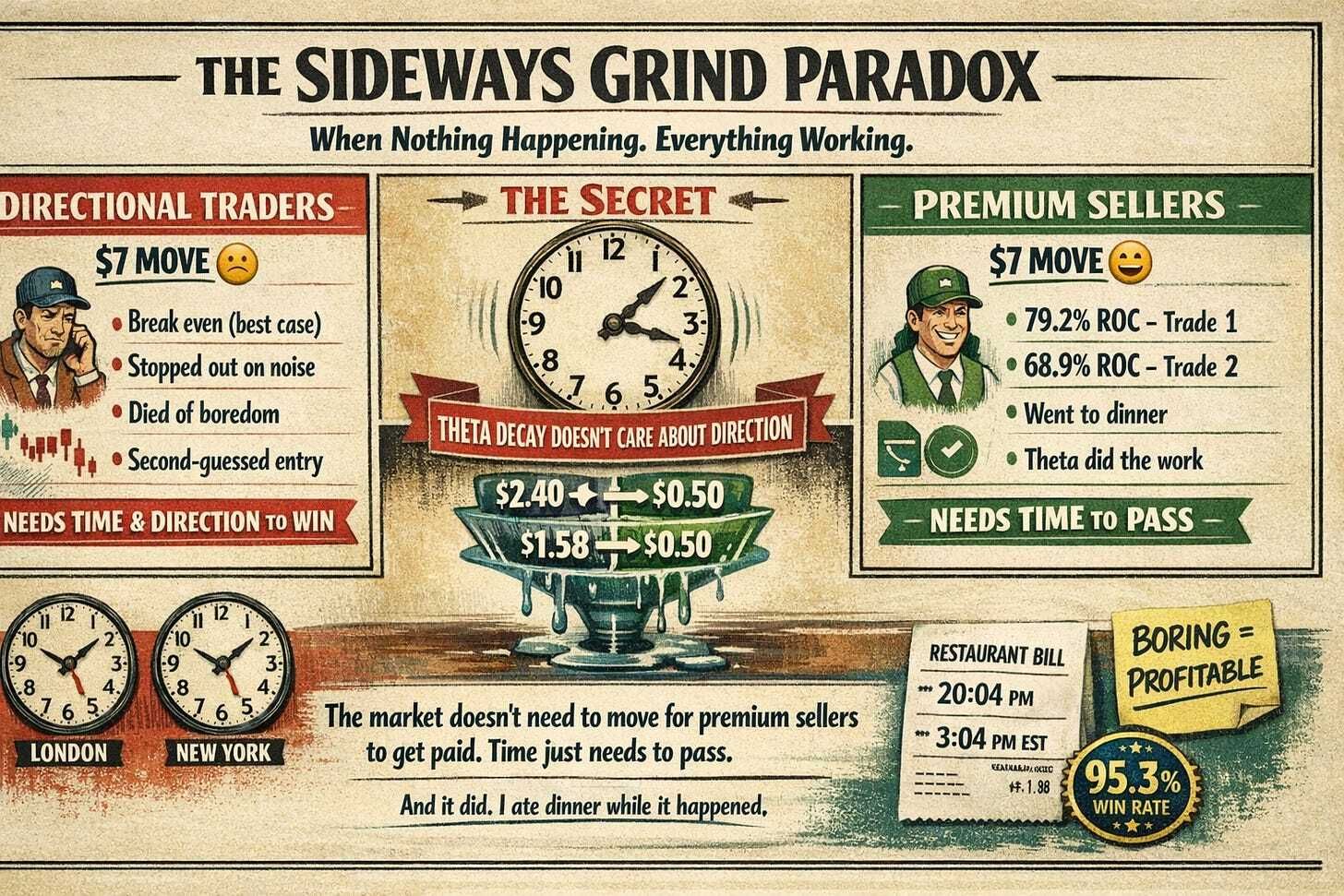

When price grinds sideways, premium sellers shine.

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

DeBriefing:

The Trades

The Setups

Trade 1 – VWAP “Sell The Rally”:

Price firmly under 2-day VWAP = bearish bias locked

Current day’s VWAP used as entry trigger

Prior day’s lows broken = classic pullback setup

Not the cleanest entry (B+ not A+) but the setup is the setup

Trade 2 – ORB20 Breakout:

Classic 20-minute opening range breakout

Stats backing: 95.3% win rate (61 of 64) in last 30 days

High confidence entry

Clean mechanical trigger

Here’s where premium selling shines again.

Price essentially grinded sideways with a meagre $7 move after the initial clear setups.

The same setups on Futures or stock would have produced a break even or tiny gain – assuming stops weren’t hit or boredom didn’t kick in.

Premium Poppers? Benefited from the sideways grind and watched the premium pop.

Both bought back for $0.50 later on in the day.

79.2% and 68.9% ROC respectively.

The Stats That Matter

RUT Premium Popper Performance (Last 30 Days):

Bull Win Rate: 97.4% (37 of 38)

Bear Win Rate: 92.3% (24 of 26)

Total Win Rate: 95.3% (61 of 64)

Final Notes

Two setups. Two winners. One sideways grind.

$7 of movement that would bore a futures trader to tears.

148% combined ROC.

That’s the premium selling advantage.

Fun Fact:

A $7 index move would barely cover commissions for futures traders. For premium sellers? It’s theta collection paradise. 148% combined ROC on a “boring” day.

Here’s the dirty secret about premium selling that directional traders never learn: we don’t need the market to move.

In fact, we often prefer it when it doesn’t.

A $7 sideways grind after a clear setup would have futures traders checking their phones, second-guessing their entries, maybe getting stopped out on noise, or simply dying of boredom.

Premium sellers? We collected $2.40 and $1.58, watched theta do its thing , and bought both back for $0.50

That’s 79.2% and 68.9% ROC on what most traders would call “nothing happening.”

The market doesn’t need to move for us to get paid. Time just needs to pass. And last time I checked, time passes whether you’re watching charts or eating dinner.

Sideways grind? Paid.

Theta decay? Working.

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System (includes 7+ mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!

Reply